Today Goldman published two of the bank's most widely read periodic reports: the Hedge Fund Trend Monitor (available to pro subs here) and Mutual Fundamentals (also available here), which summarize the quarterly activity and flows of hedge and mutual funds, respectively. Both are available to pro subs in the usual place, but here are the key points from each report.

Hedge Fund trend monitor

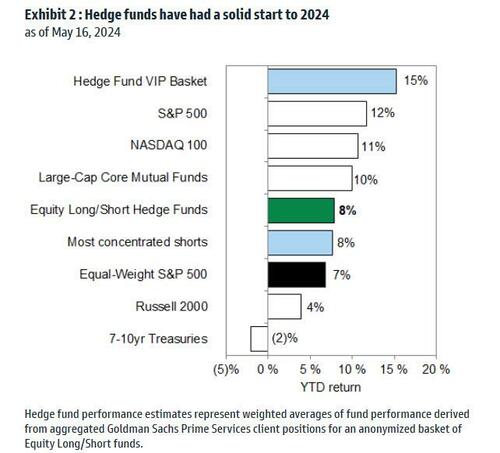

1) PERFORMANCE: US equity long/short hedge funds have generated a solid +8% YTD return. The strong performance of popular hedge fund long positions has boosted hedge fund returns despite a recent short squeeze in popular shorted stocks. Goldman's Hedge Fund VIP list of the most popular long positions (ticker: GSTHHVIP) has returned +16% YTD, outperforming the S&P 500 (+12%) and the equal-weight S&P 500 (+7%). The most shorted stocks (GSCBMSAL, +7% YTD) surged +25% in mid-May.

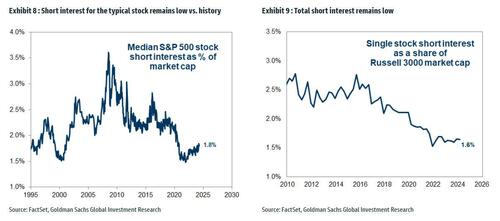

2) LEVERAGE AND SHORT INTEREST: Hedge funds have modestly lifted net leverage alongside the broader market rally while maintaining record gross leverage. Concentrated short positions have been particularly volatile recently, causing funds to rotate out of their favorite longs to cover shorts. However, the most recent short squeeze fell shy of the recent experiences in 2021 and December 2023. Short interest for the median S&P 500 stock remains very low at 1.8% of float. Instead, funds continue to use macro products.

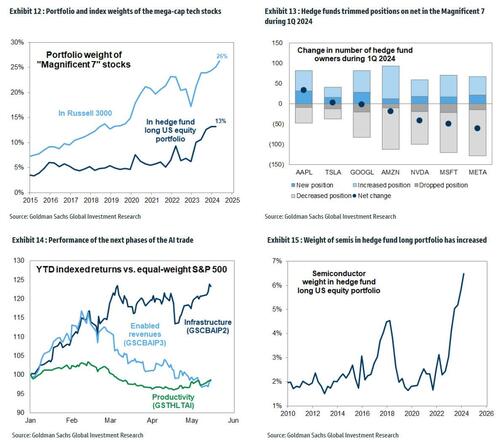

3) HEDGE FUND VIPS: Mega-caps remain the most popular hedge fund long positions. AMZN, MSFT, META, GOOGL, NVDA continue to rank as the top five stocks in the VIP list this quarter, with AAPL joining the top six. The VIP list contains the 50 stocks that appear most often among the top 10 holdings of fundamental hedge funds. The basket has outperformed the S&P 500 in 60% of quarters since 2001 with an average quarterly excess return of 47 bp. 14 new constituents: ALIT, APP, DELL, DFS, GDDY, JPM, MU, NEE, SE, SN, VST, WDC, WIX, X.

4) MEGA-CAPS AND ARTIFICIAL INTELLIGENCE: Hedge funds trimmed positions in the mega-caps while adding to broader AI beneficiaries. Share price outperformance has supported the weight of the Magnificent 7 in hedge fund long portfolios, which stabilized at 13% during 1Q. AAPL was the exception where hedge funds incrementally added. In contrast, hedge funds added to winners across the entire AI universe, particularly in Phase 2 Infrastructure. MRVL, SNX, AES, LFUS are Infrastructure stocks with the largest increase in hedge fund popularity.

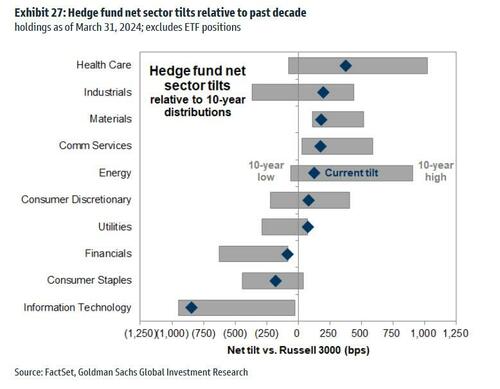

5) SECTORS: Hedge funds continued to rotate toward cyclicals, with broad-based increases across Consumer Discretionary, Financials, and Energy. DFS joined this quarter's VIP list, as did JPM, and also joined BK and SPGI to screen among this quarter's list of Rising Stars with the largest increase in hedge fund popularity. Soaring prices also lifted the weight of Semiconductor stocks in hedge fund long portfolios to a new record, at 6.5%. MRVL is the top Rising Star and MU entered our basket of favorite hedge fund long positions.

Mutual Fundamentals

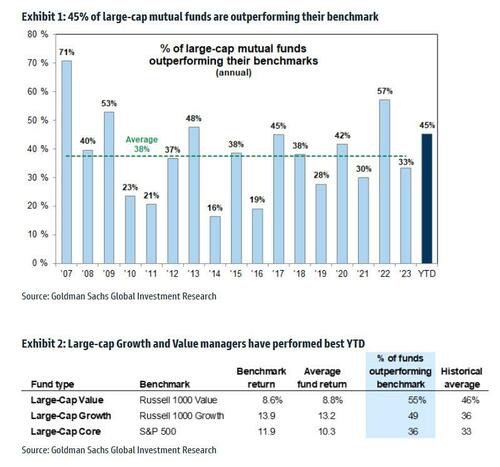

1. PERFORMANCE: Mutual funds have delivered strong results YTD. 45% of large-cap mutual funds are outperforming their benchmarks YTD, compared with the historical average of 38%.

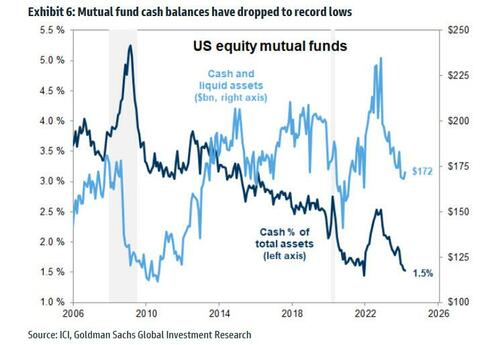

Fund managers have grown increasingly bullish on US equities, with cash allocations falling to 1.5% and matching the lowest level on record.

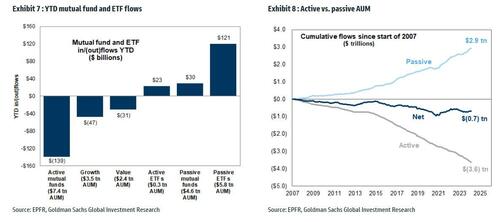

Nonetheless, active mutual funds have experienced $139 billion of outflows YTD.

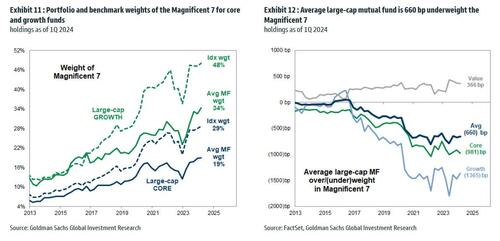

2. THEMES IN FOCUS: (1) MEGA-CAP TECH: Increasing benchmark weights and diversification restrictions mean that the average large-cap mutual fund was 660 bp underweight the Magnificent 7 in 1Q 2024, largely unchanged vs. last quarter. A net of 120 funds (25%) reduced their exposure to MSFT, the largest decline across the group.

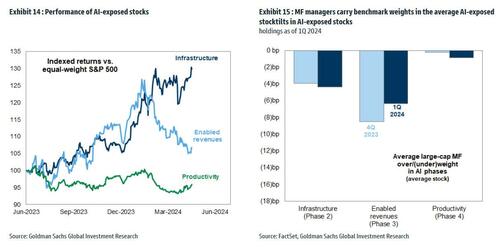

(2) AI: Despite the broadening of the AI trade across share prices, mutual fund managers generally avoided taking large tracking error on the theme. However, mutual funds lifted their exposure to Utilities to a new 10-year high.

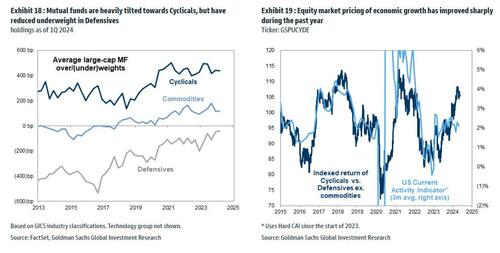

(3) CYCLICALS/DEFENSIVES: The average large-cap mutual fund maintained a 437 bp overweight in cyclical industries vs. the benchmark, which has benefited performance as investor confidence about economic growth drove Cyclicals to outperform Defensives (GSPUCYDE) by 4% YTD.

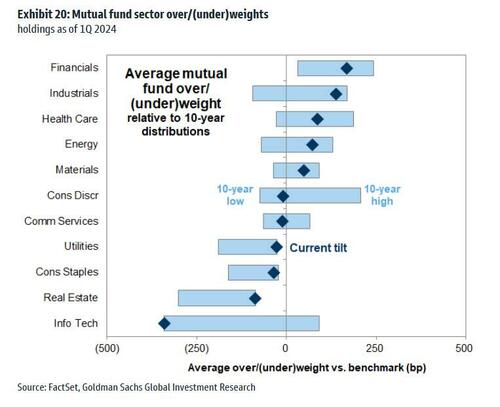

3. SECTORS: The average large-cap mutual fund is currently most overweight Financials (+167 bp) and Industrials (+139 bp) and most underweight Info Tech (-341 bp).

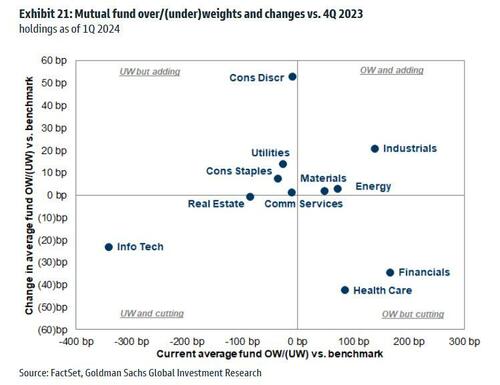

Relative to 4Q 2023, the average fund increased exposure most to Consumer Discretionary (+53 bp) and cut the most to Health Care (-42 bp) and Financials (-34 bp).

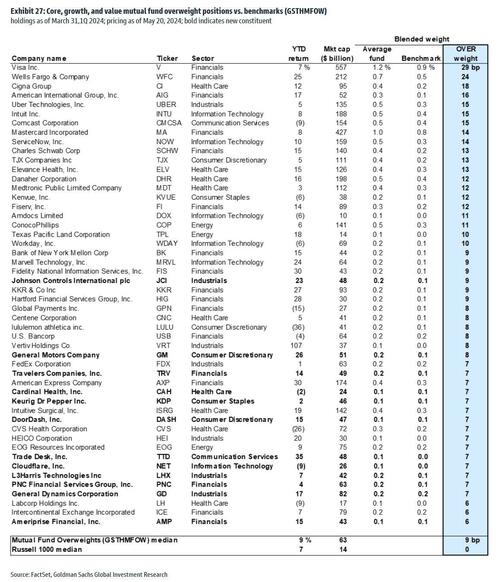

4. STOCKS: Goldman has rebalanced its Mutual Fund Overweight (GSTHMFOW) and Mutual Fund Underweight (GSTHMFUW) baskets in this report. 12 new constituents in GSTHMFOW: JCI, GM, TRV, CAH, KDP, DASH, TTD, NET, LHX, PNC, GD, AMP.

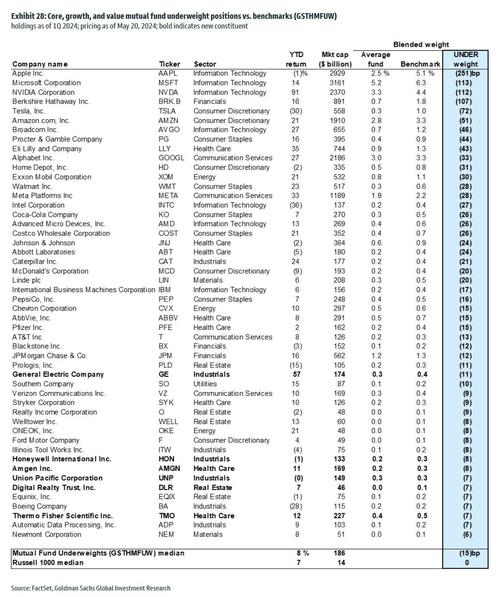

6 new constituents in GSTHMFUW: GE, HON, AMGN, UNP, DLR, TMO.

Much more in the full reports available to pro subs (here and here)

Today Goldman published two of the bank's most widely read periodic reports: the Hedge Fund Trend Monitor (available to pro subs here) and Mutual Fundamentals (also available here), which summarize the quarterly activity and flows of hedge and mutual funds, respectively. Both are available to pro subs in the usual place, but here are the key points from each report.

Hedge Fund trend monitor

1) PERFORMANCE: US equity long/short hedge funds have generated a solid +8% YTD return. The strong performance of popular hedge fund long positions has boosted hedge fund returns despite a recent short squeeze in popular shorted stocks. Goldman's Hedge Fund VIP list of the most popular long positions (ticker: GSTHHVIP) has returned +16% YTD, outperforming the S&P 500 (+12%) and the equal-weight S&P 500 (+7%). The most shorted stocks (GSCBMSAL, +7% YTD) surged +25% in mid-May.

2) LEVERAGE AND SHORT INTEREST: Hedge funds have modestly lifted net leverage alongside the broader market rally while maintaining record gross leverage. Concentrated short positions have been particularly volatile recently, causing funds to rotate out of their favorite longs to cover shorts. However, the most recent short squeeze fell shy of the recent experiences in 2021 and December 2023. Short interest for the median S&P 500 stock remains very low at 1.8% of float. Instead, funds continue to use macro products.

3) HEDGE FUND VIPS: Mega-caps remain the most popular hedge fund long positions. AMZN, MSFT, META, GOOGL, NVDA continue to rank as the top five stocks in the VIP list this quarter, with AAPL joining the top six. The VIP list contains the 50 stocks that appear most often among the top 10 holdings of fundamental hedge funds. The basket has outperformed the S&P 500 in 60% of quarters since 2001 with an average quarterly excess return of 47 bp. 14 new constituents: ALIT, APP, DELL, DFS, GDDY, JPM, MU, NEE, SE, SN, VST, WDC, WIX, X.

4) MEGA-CAPS AND ARTIFICIAL INTELLIGENCE: Hedge funds trimmed positions in the mega-caps while adding to broader AI beneficiaries. Share price outperformance has supported the weight of the Magnificent 7 in hedge fund long portfolios, which stabilized at 13% during 1Q. AAPL was the exception where hedge funds incrementally added. In contrast, hedge funds added to winners across the entire AI universe, particularly in Phase 2 Infrastructure. MRVL, SNX, AES, LFUS are Infrastructure stocks with the largest increase in hedge fund popularity.

5) SECTORS: Hedge funds continued to rotate toward cyclicals, with broad-based increases across Consumer Discretionary, Financials, and Energy. DFS joined this quarter's VIP list, as did JPM, and also joined BK and SPGI to screen among this quarter's list of Rising Stars with the largest increase in hedge fund popularity. Soaring prices also lifted the weight of Semiconductor stocks in hedge fund long portfolios to a new record, at 6.5%. MRVL is the top Rising Star and MU entered our basket of favorite hedge fund long positions.

Mutual Fundamentals

1. PERFORMANCE: Mutual funds have delivered strong results YTD. 45% of large-cap mutual funds are outperforming their benchmarks YTD, compared with the historical average of 38%.

Fund managers have grown increasingly bullish on US equities, with cash allocations falling to 1.5% and matching the lowest level on record.

Nonetheless, active mutual funds have experienced $139 billion of outflows YTD.

2. THEMES IN FOCUS: (1) MEGA-CAP TECH: Increasing benchmark weights and diversification restrictions mean that the average large-cap mutual fund was 660 bp underweight the Magnificent 7 in 1Q 2024, largely unchanged vs. last quarter. A net of 120 funds (25%) reduced their exposure to MSFT, the largest decline across the group.

(2) AI: Despite the broadening of the AI trade across share prices, mutual fund managers generally avoided taking large tracking error on the theme. However, mutual funds lifted their exposure to Utilities to a new 10-year high.

(3) CYCLICALS/DEFENSIVES: The average large-cap mutual fund maintained a 437 bp overweight in cyclical industries vs. the benchmark, which has benefited performance as investor confidence about economic growth drove Cyclicals to outperform Defensives (GSPUCYDE) by 4% YTD.

3. SECTORS: The average large-cap mutual fund is currently most overweight Financials (+167 bp) and Industrials (+139 bp) and most underweight Info Tech (-341 bp).

Relative to 4Q 2023, the average fund increased exposure most to Consumer Discretionary (+53 bp) and cut the most to Health Care (-42 bp) and Financials (-34 bp).

4. STOCKS: Goldman has rebalanced its Mutual Fund Overweight (GSTHMFOW) and Mutual Fund Underweight (GSTHMFUW) baskets in this report. 12 new constituents in GSTHMFOW: JCI, GM, TRV, CAH, KDP, DASH, TTD, NET, LHX, PNC, GD, AMP.

6 new constituents in GSTHMFUW: GE, HON, AMGN, UNP, DLR, TMO.

Much more in the full reports available to pro subs (here and here)