By Michael Msika, Bloomberg Markets Live reporter and startegist

The outlook for the economy and corporate profits may be improving, but that’s not enough to make strategists significantly more bullish for the rest of the year.

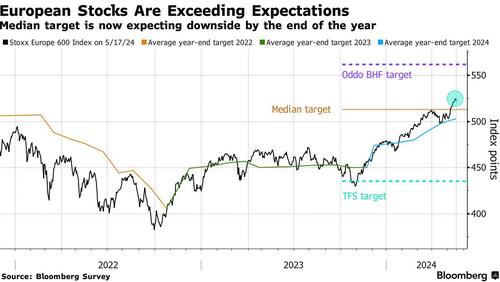

That’s the takeaway from our monthly survey, which show European stocks have gotten ahead of themselves after gaining about 9% this year. The Stoxx Europe 600 Index will end the year at 503 points, 4% below last Thursday’s close, according to the average prediction in a poll of 14 equity strategists. While the median forecast has risen a little higher to 513, that’s still only the level at which the index was trading earlier this month.

Some strategists have raised their targets from a month ago, including the most bearish ones Bank of America and TFS Derivatives, as well as ING. But none of those is seeing any upside from current levels.

“We remain negative on European equities,” say BofA strategists led by Sebastian Raedler, who hiked their year-end target from 430 to 460 this month, still seeing over 12% downside ahead.

They acknowledge that fading US inflation could support the market in the near term through a dovish repricing in Fed policy expectations. However, the intensification of US labor-market weakness will eventually become the dominant market driver, leading to rising risk premia and fading EPS expectations, they add.

So far, earnings have been stronger than expected. The first-quarter results season has provided positive surprises in Europe, fueling corporate profit upgrades and driving expectations for the markets to keep building the rally.

“The expected sluggish earnings season turned out to be better than feared in aggregate,” say BNP Paribas strategists led by Georges Debbas, pointing out that three-quarters of companies met or exceeded earnings expectations, with even margins improving against all odds.

“Disinflation and other factors could put additional pressure on European margins,” say Citi strategists led by Beata Manthey, with a more upbeat 540 target. “However, this does not change our call for relatively solid European EPS growth of +6% in 2024, which should justify some additional equity upside to year-end.”

What’s more, the divergence in monetary policy relative to the US is likely to serve as a tailwind for the region’s stocks. The European Central Bank has struck a more dovish tone than the Fed over the past few months, and bond markets are expecting the central bank to cut rates before its US counterpart.

That’s keeping investors bullish. According to the BofA European fund managers survey published last week, 78% of participants expect further near-term gains for European equities, up from 52% last month. 51% think European market upside will be driven by a declining discount rate, as fading inflation leads the ECB to ease policy, while 37% are counting on earnings upgrades in response to macro resilience, the survey shows.

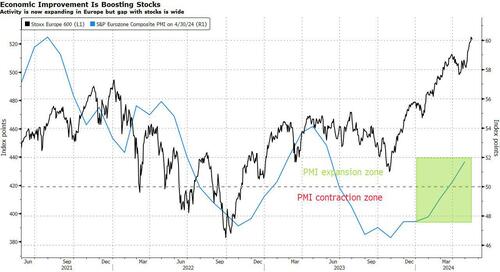

“Irrespective of the volatility of US cut expectations, we believe the growth/policy mix in Europe is getting more favorable,” says Barclays strategist Emmanuel Cau, who also has a 540 year-end target for the Stoxx 600. “We see green shoots emerging in the economy, while upcoming ECB/BOE cuts should open up opportunities within the market.”

By Michael Msika, Bloomberg Markets Live reporter and startegist

The outlook for the economy and corporate profits may be improving, but that’s not enough to make strategists significantly more bullish for the rest of the year.

That’s the takeaway from our monthly survey, which show European stocks have gotten ahead of themselves after gaining about 9% this year. The Stoxx Europe 600 Index will end the year at 503 points, 4% below last Thursday’s close, according to the average prediction in a poll of 14 equity strategists. While the median forecast has risen a little higher to 513, that’s still only the level at which the index was trading earlier this month.

Some strategists have raised their targets from a month ago, including the most bearish ones Bank of America and TFS Derivatives, as well as ING. But none of those is seeing any upside from current levels.

“We remain negative on European equities,” say BofA strategists led by Sebastian Raedler, who hiked their year-end target from 430 to 460 this month, still seeing over 12% downside ahead.

They acknowledge that fading US inflation could support the market in the near term through a dovish repricing in Fed policy expectations. However, the intensification of US labor-market weakness will eventually become the dominant market driver, leading to rising risk premia and fading EPS expectations, they add.

So far, earnings have been stronger than expected. The first-quarter results season has provided positive surprises in Europe, fueling corporate profit upgrades and driving expectations for the markets to keep building the rally.

“The expected sluggish earnings season turned out to be better than feared in aggregate,” say BNP Paribas strategists led by Georges Debbas, pointing out that three-quarters of companies met or exceeded earnings expectations, with even margins improving against all odds.

“Disinflation and other factors could put additional pressure on European margins,” say Citi strategists led by Beata Manthey, with a more upbeat 540 target. “However, this does not change our call for relatively solid European EPS growth of +6% in 2024, which should justify some additional equity upside to year-end.”

What’s more, the divergence in monetary policy relative to the US is likely to serve as a tailwind for the region’s stocks. The European Central Bank has struck a more dovish tone than the Fed over the past few months, and bond markets are expecting the central bank to cut rates before its US counterpart.

That’s keeping investors bullish. According to the BofA European fund managers survey published last week, 78% of participants expect further near-term gains for European equities, up from 52% last month. 51% think European market upside will be driven by a declining discount rate, as fading inflation leads the ECB to ease policy, while 37% are counting on earnings upgrades in response to macro resilience, the survey shows.

“Irrespective of the volatility of US cut expectations, we believe the growth/policy mix in Europe is getting more favorable,” says Barclays strategist Emmanuel Cau, who also has a 540 year-end target for the Stoxx 600. “We see green shoots emerging in the economy, while upcoming ECB/BOE cuts should open up opportunities within the market.”