Starwood Real Estate Income Trust (SREIT), a $10 billion non-traded REIT ranked second-largest behind Blackstone's struggling BREIT, faces a severe liquidity crunch as investor redemptions soar amid concerns 'higher for longer' interest rates will worsen the commercial real estate storm.

The Financial Times reported at the end of last week that SREIT is "running low on liquidity as investors demand their money back" and tapped $1.3 billion of its $1.55 billion credit facility since the start of 2023.

Redemptions have jumped among concerned investors. In the first quarter, SREIT investors requested $1.3 billion of their cash back. However, the fund only returned $500 million of the requests in the quarter because of a 5% redemption cap.

Now, Barry Sternlicht's SREIT is in dire straits. The current pace of redemptions suggests the fund will run out of cash in the second half of the year unless it disposes of properties or expands its credit facility. The filing from last week shows the fund has $225 million left to draw down.

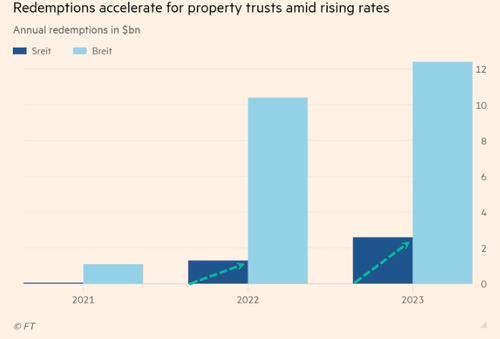

The outflows are similar to what happened to Blackstone's BREIT over the last few years. At least now, BREIT has been able to meet 100% of its redemption requests for the first time since 2022, according to a notice issued by Blackstone to investors on March 1.

"Liquidity isn't something that people think about on the way up, but it can become a concern suddenly," Phil Bak, chief executive of Armada Investors, which invests in listed REITs.

Bak said, "When it comes to private REITs, liquidity concerns have been dismissed, and they will become paramount again."

FT spoke with an individual close to SREIT who said 'greater liquidity' is expected soon after asset sales. They said, "Starwood could sell other assets to raise cash."

The REIT industry has been under severe pressure since Fed chair Powell began raising interest rates in early 2022. Tighter monetary conditions and higher interest rates for the medium term as inflation remains elevated have pressured CRE values of office towers. This has led to a 16% decline in SREIT's declared net asset value from its peak in September 2022 at nearly $10 billion.

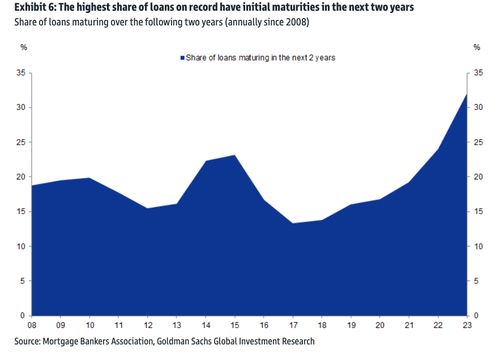

For the CRE industry, Goldman's Lotfi Karoui outlined days ago that the highest share of CRE loans on record will hit maturity walls in the next two years.

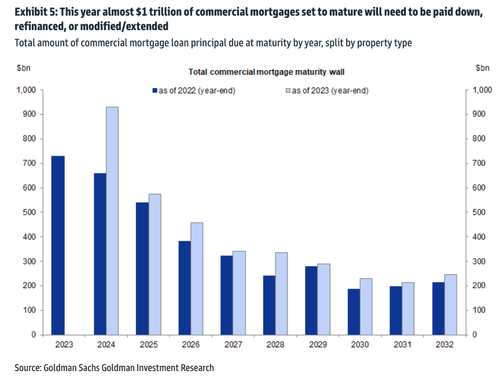

Almost a trillion of CRE mortgages must be paid down, refinanced, or extended by the end of 2024.

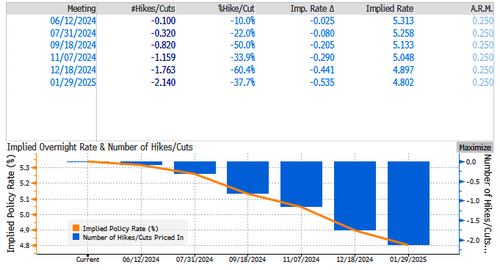

The problem is that the Fed's rate cut cycle has been pushed out to at least the fall. Interest-rate swaps on Friday showed traders pricing about two quarter-point rate cuts by year-end, with about an 80% chance the first one will come in September.

Between SREIT and BREIT, the smart money has been panic-running for the exit door. Redemption caps have saved these non-traded REITs from totally imploding.

Starwood Real Estate Income Trust (SREIT), a $10 billion non-traded REIT ranked second-largest behind Blackstone's struggling BREIT, faces a severe liquidity crunch as investor redemptions soar amid concerns 'higher for longer' interest rates will worsen the commercial real estate storm.

The Financial Times reported at the end of last week that SREIT is "running low on liquidity as investors demand their money back" and tapped $1.3 billion of its $1.55 billion credit facility since the start of 2023.

Redemptions have jumped among concerned investors. In the first quarter, SREIT investors requested $1.3 billion of their cash back. However, the fund only returned $500 million of the requests in the quarter because of a 5% redemption cap.

Now, Barry Sternlicht's SREIT is in dire straits. The current pace of redemptions suggests the fund will run out of cash in the second half of the year unless it disposes of properties or expands its credit facility. The filing from last week shows the fund has $225 million left to draw down.

The outflows are similar to what happened to Blackstone's BREIT over the last few years. At least now, BREIT has been able to meet 100% of its redemption requests for the first time since 2022, according to a notice issued by Blackstone to investors on March 1.

"Liquidity isn't something that people think about on the way up, but it can become a concern suddenly," Phil Bak, chief executive of Armada Investors, which invests in listed REITs.

Bak said, "When it comes to private REITs, liquidity concerns have been dismissed, and they will become paramount again."

FT spoke with an individual close to SREIT who said 'greater liquidity' is expected soon after asset sales. They said, "Starwood could sell other assets to raise cash."

The REIT industry has been under severe pressure since Fed chair Powell began raising interest rates in early 2022. Tighter monetary conditions and higher interest rates for the medium term as inflation remains elevated have pressured CRE values of office towers. This has led to a 16% decline in SREIT's declared net asset value from its peak in September 2022 at nearly $10 billion.

For the CRE industry, Goldman's Lotfi Karoui outlined days ago that the highest share of CRE loans on record will hit maturity walls in the next two years.

Almost a trillion of CRE mortgages must be paid down, refinanced, or extended by the end of 2024.

The problem is that the Fed's rate cut cycle has been pushed out to at least the fall. Interest-rate swaps on Friday showed traders pricing about two quarter-point rate cuts by year-end, with about an 80% chance the first one will come in September.

Between SREIT and BREIT, the smart money has been panic-running for the exit door. Redemption caps have saved these non-traded REITs from totally imploding.