By Benjamin Picton, senior macro strategist at Rabobank

Bonds sold off on Friday and the NASDAQ closed a smidgen lower. Both the S&P500 and the Dow Jones managed minor gains, with the Dow’s outperformance again suggesting that equities continue to trade on sensitivity to discount rates. Two-year yields rose 3bps on Friday while 10-year yields managed a gain of 4.7bps, bear-steepening the curve.

Brent crude is trading just a touch above Friday’s close of $83.98/bbl, despite news over the weekend that Iranian President Ebrahim Raisi is missing after a helicopter carrying both he and Foreign Minister Amirabdollahian crashed in mountainous terrain in the country’s north-west. Latest reports suggest that the wreckage has been spotted by search teams, but that no signs of life have yet been detected.

While there is no suggestion of foul play, it is certainly not ideal for senior Iranian political figures to be involved in helicopter accidents while tensions between Israel and Iran remain in a heightened state. The Economist has suggested that if Raisi has been killed it could set off a power struggle in Iran as he was a leading candidate to become the eventual successor for Supreme Leader Khameini. Nevertheless, the reaction in the energy complex suggests that traders remain untroubled by the news.

Shifting to interest rate world, the post-CPI jubilation had clearly begun to wane at the end of last week as a number of Fed speakers took turns watering down the proverbial punch bowl. Mester, Williams and Barkin all talked down the prospects for rate cuts, suggesting that possibly, maybe, it might be appropriate to cut rates before the end of the year. Or it might not.

Mester – one of the FOMC’s more hawkish members – will be stepping down at the end of June. She scores +1 on Bloomberg Economics’ hawk/dove spectrometer. Under the FOMC’s current composition, the Spectrometer sums to zero (neither hawkish nor dovish), which means that the incoming President of the Cleveland Fed – who will remain a voting member in 2024 and 2025 –has the potential to tip the Fed’s overall bias in either direction.

Meanwhile, Bowman (perhaps the FOMCs most hawkish member) said that progress on labour market re-balancing has slowed, the Fed is monitoring to see if policy is sufficiently restrictive, and she is willing to hike again if inflation rises.

We could forgive Fed speakers for couching tentative predictions of future rate cuts in caveats around the potential for inflation to rise again. Last week’s CPI – while welcome - was the first release in three months that didn’t surprise to the upside. After the Powell pivot late last year sparked frenzied speculation of the timing and quantum of rate cuts, it only seems wise to be a little more circumspect this time around when the data falls the Fed’s way.

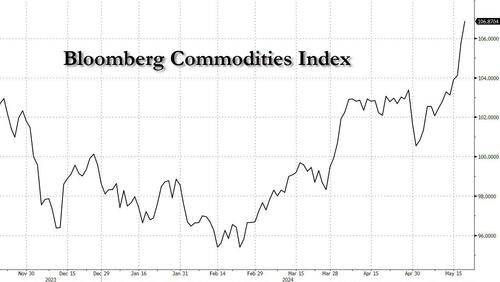

Indeed, the Bloomberg commodities index is warning not to write inflation’s obituary just yet. It has been rallying since February and is now at its highest reading since October last year. Cocoa has pulled back substantially since its April highs, as have cotton, sugar and coffee, but these have been more than offset by recent runups in aluminium, nickel, copper, silver, iron ore, steel, orange juice concentrate, soybeans, wheat, beef, gold, natural gas and diesel, while the recent ban on enriched uranium imports from Russia could also add to price pressures in the nuclear fuels supply chain. Higher commodity prices are obviously unhelpful while core services inflation remains a problem.

Overall, it seems that we’re back to “waiting for more data” for the time being, but the May FOMC meeting minutes due out later this week will still be a key point of interest for markets.

The Reserve Bank of New Zealand will be another point of interest as it meets to set the official cash rate. No changes are expected from the prevailing 5.50%, but the scheduled release of the Monetary Policy Statement – which includes updated forecasts – will be important for the local market.

The RBNZ has established a reputation as something of a bellwether for global interest rate cycles. With the economy in recession and the labour market showing recent signs of rapid softening, it will be worth keeping an eye on whether the RBNZ flags the possibility of an earlier cut to the policy rate than their current mid-2025 guidance.

The minutes of the RBA’s May policy meeting are also due to be released this week and may provide a point of contrast. While the RBNZ has the luxury of a singular focus on inflation, the RBA must reconcile its price stability objective with a full-employment mandate. That probably goes some way toward explaining the absence of any hawkish tilt from the RBA in May, even as Q1 inflation and labour market data prior to the meeting had been surprising on the strong side.

As Leonard Nimoy once said “if you chase two rabbits, you will lose them both”.

By Benjamin Picton, senior macro strategist at Rabobank

Bonds sold off on Friday and the NASDAQ closed a smidgen lower. Both the S&P500 and the Dow Jones managed minor gains, with the Dow’s outperformance again suggesting that equities continue to trade on sensitivity to discount rates. Two-year yields rose 3bps on Friday while 10-year yields managed a gain of 4.7bps, bear-steepening the curve.

Brent crude is trading just a touch above Friday’s close of $83.98/bbl, despite news over the weekend that Iranian President Ebrahim Raisi is missing after a helicopter carrying both he and Foreign Minister Amirabdollahian crashed in mountainous terrain in the country’s north-west. Latest reports suggest that the wreckage has been spotted by search teams, but that no signs of life have yet been detected.

While there is no suggestion of foul play, it is certainly not ideal for senior Iranian political figures to be involved in helicopter accidents while tensions between Israel and Iran remain in a heightened state. The Economist has suggested that if Raisi has been killed it could set off a power struggle in Iran as he was a leading candidate to become the eventual successor for Supreme Leader Khameini. Nevertheless, the reaction in the energy complex suggests that traders remain untroubled by the news.

Shifting to interest rate world, the post-CPI jubilation had clearly begun to wane at the end of last week as a number of Fed speakers took turns watering down the proverbial punch bowl. Mester, Williams and Barkin all talked down the prospects for rate cuts, suggesting that possibly, maybe, it might be appropriate to cut rates before the end of the year. Or it might not.

Mester – one of the FOMC’s more hawkish members – will be stepping down at the end of June. She scores +1 on Bloomberg Economics’ hawk/dove spectrometer. Under the FOMC’s current composition, the Spectrometer sums to zero (neither hawkish nor dovish), which means that the incoming President of the Cleveland Fed – who will remain a voting member in 2024 and 2025 –has the potential to tip the Fed’s overall bias in either direction.

Meanwhile, Bowman (perhaps the FOMCs most hawkish member) said that progress on labour market re-balancing has slowed, the Fed is monitoring to see if policy is sufficiently restrictive, and she is willing to hike again if inflation rises.

We could forgive Fed speakers for couching tentative predictions of future rate cuts in caveats around the potential for inflation to rise again. Last week’s CPI – while welcome - was the first release in three months that didn’t surprise to the upside. After the Powell pivot late last year sparked frenzied speculation of the timing and quantum of rate cuts, it only seems wise to be a little more circumspect this time around when the data falls the Fed’s way.

Indeed, the Bloomberg commodities index is warning not to write inflation’s obituary just yet. It has been rallying since February and is now at its highest reading since October last year. Cocoa has pulled back substantially since its April highs, as have cotton, sugar and coffee, but these have been more than offset by recent runups in aluminium, nickel, copper, silver, iron ore, steel, orange juice concentrate, soybeans, wheat, beef, gold, natural gas and diesel, while the recent ban on enriched uranium imports from Russia could also add to price pressures in the nuclear fuels supply chain. Higher commodity prices are obviously unhelpful while core services inflation remains a problem.

Overall, it seems that we’re back to “waiting for more data” for the time being, but the May FOMC meeting minutes due out later this week will still be a key point of interest for markets.

The Reserve Bank of New Zealand will be another point of interest as it meets to set the official cash rate. No changes are expected from the prevailing 5.50%, but the scheduled release of the Monetary Policy Statement – which includes updated forecasts – will be important for the local market.

The RBNZ has established a reputation as something of a bellwether for global interest rate cycles. With the economy in recession and the labour market showing recent signs of rapid softening, it will be worth keeping an eye on whether the RBNZ flags the possibility of an earlier cut to the policy rate than their current mid-2025 guidance.

The minutes of the RBA’s May policy meeting are also due to be released this week and may provide a point of contrast. While the RBNZ has the luxury of a singular focus on inflation, the RBA must reconcile its price stability objective with a full-employment mandate. That probably goes some way toward explaining the absence of any hawkish tilt from the RBA in May, even as Q1 inflation and labour market data prior to the meeting had been surprising on the strong side.

As Leonard Nimoy once said “if you chase two rabbits, you will lose them both”.