As the Bitcoin and Ethereum prices exploded toward new all-time highs, the recently piled-on shorts have suffered the brunt of the liquidations. In the last day alone, over $360 million was liquidated from the crypto market with the majority hitting short traders.

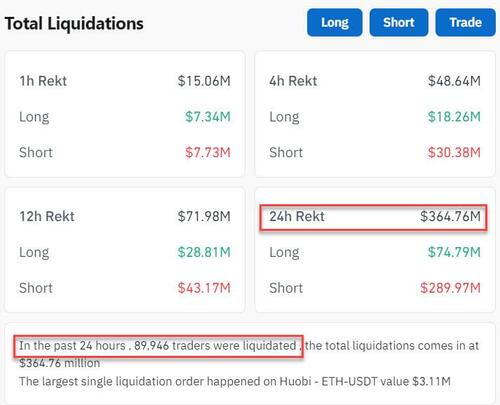

Coinglass data shows that the last 24 hours have been brutal for crypto shorts, with almost 90,000 crypto traders seeing their positions liquidated, the vast majority of them short, leading to hundreds of millions of dollars in losses.

In total, there have been $365 million in liquidations. Out of this figure, the vast majority, or 80%, were positions belonging to short traders, meaning they made up $290 million of the total figure. Long traders only made up $75 million in the liquidations.

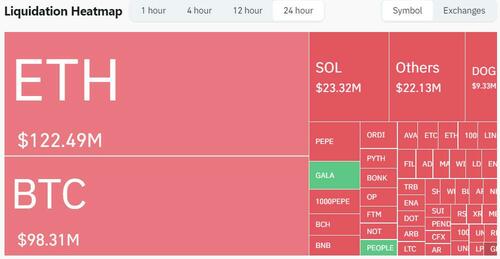

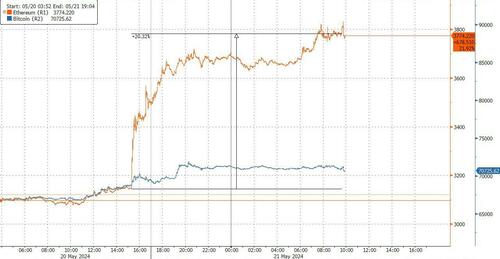

Bitcoin did not lead liquidations this time around, with the pain instead focusing on Ethereum, as its price soared more than 20% in the 24-hour period, following media reports suggesting that contrary to previous expectations, the SEC was actually prepared to greenlight an Ethereum ETF.

Ethereum liquidations accounted for around 35% of the total figure, coming out to $122 million at the time of writing. The largest single liquidation event also happened on an ETH-USDT pair on the Huobi exchange, costing the trader $3.11 million.

In contrast, Bitcoin liquidations came out to $98 million, but just like Ethereum, the figure was made up by a majority of short traders.

Following behind Bitcoin is Solana with liquidations of $23.3 million. Other coins which saw substantial liquidations include Dogecoin with $9.3 million, PEPE and others.

As the Bitcoin and Ethereum prices exploded toward new all-time highs, the recently piled-on shorts have suffered the brunt of the liquidations. In the last day alone, over $360 million was liquidated from the crypto market with the majority hitting short traders.

Coinglass data shows that the last 24 hours have been brutal for crypto shorts, with almost 90,000 crypto traders seeing their positions liquidated, the vast majority of them short, leading to hundreds of millions of dollars in losses.

In total, there have been $365 million in liquidations. Out of this figure, the vast majority, or 80%, were positions belonging to short traders, meaning they made up $290 million of the total figure. Long traders only made up $75 million in the liquidations.

Bitcoin did not lead liquidations this time around, with the pain instead focusing on Ethereum, as its price soared more than 20% in the 24-hour period, following media reports suggesting that contrary to previous expectations, the SEC was actually prepared to greenlight an Ethereum ETF.

Ethereum liquidations accounted for around 35% of the total figure, coming out to $122 million at the time of writing. The largest single liquidation event also happened on an ETH-USDT pair on the Huobi exchange, costing the trader $3.11 million.

In contrast, Bitcoin liquidations came out to $98 million, but just like Ethereum, the figure was made up by a majority of short traders.

Following behind Bitcoin is Solana with liquidations of $23.3 million. Other coins which saw substantial liquidations include Dogecoin with $9.3 million, PEPE and others.