As discussed in our preview, Nvidia has been called the mother of all earnings -- the "single most important stock on the planet" according to Goldman - and for good reason: it accounts for 5% of the S&P. This morning, Mizuho’s desk analyst even said “they are the market in AI in many respects.”

So intense is the interest in today’s print that according to Bloomberg, some investors and onlookers I’ve heard from are making assessments of Jensen Huang’s body language when I spoke to him on Bloomberg Television in Las Vegas on Monday. They want any and all clues about whether this is going to go well. My conclusion from that conversation: Nvidia knows it needs to make sales beyond just cloud providers and is seeking fortune in enterprise and government markets (with help from Dell).

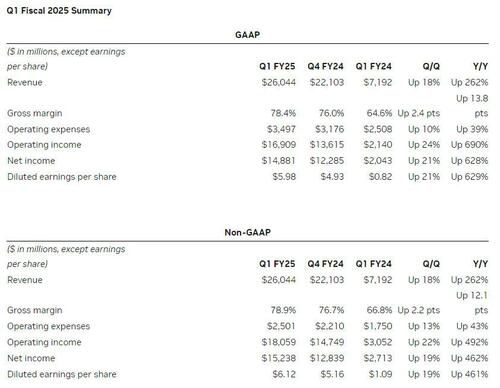

So with that preamble for what may be the most important earnings release this quarter, if not this year, here is what NVDA just reported for Q1:

- Revenue $26.04 billion (up from $7.19 billion y/y) and destroying estimates of $24.69 billion

- Data center revenue $22.6 billion vs. $4.28 billion y/y, smashing estimates of $21.13 billion. This is the all important one

- Professional Visualization revenue $427 million, +45% y/y, missing estimates of $479.1 million

- Automotive revenue $329 million, +11% y/y, beating estimates of $292.4 million

- Adjusted gross margin 78.9% vs. 66.8% y/y, blowing away estimates of 77%

- R&D expenses $2.72 billion, +45% y/y, in line with estimate $2.73 billion

- Adjusted operating expenses $2.50 billion, +43% y/y, in line with estimates of $2.51 billion

- Adjusted operating income $18.06 billion vs. $3.05 billion y/y, crushing estimates of $16.46 billion

- Free cash flow $14.94 billion vs. $2.64 billion y/y, estimate $12.29 billion

While the company blew away Q1 expectations, attention was on Q2 and specifically the revenue bogey where we said earlier $28BN was the magical number that would determine if the stock would plunge or soar. Well, not surprisingly, here is what NVDA just previewed for the second quarter:

- Revenue is expected to be $28.0 billion, plus or minus 2%.

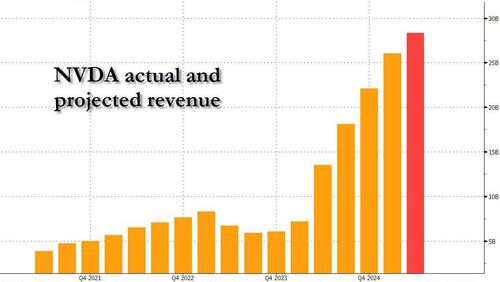

Or right on the screws, and judging by the company's track record, that "plus or minus" will be a "plus", so realistically we are looking at almost $29 billion! Here is the only chart that matters.

Other guidance for Q2 and full year was the following:

- GAAP and non-GAAP gross margins are expected to be 74.8% and 75.5% (+/- 50 basis points). For the full year, gross margins are expected to be in the mid-70% range.

- GAAP and non-GAAP operating expenses are expected to be approximately $4.0 billion and $2.8 billion, respectively. Full-year operating expenses are expected to grow in the low-40% range.

- GAAP and non-GAAP other income and expense are expected to be an income of approximately $300 million, excluding gains and losses from non-affiliated investments.

- GAAP and non-GAAP tax rates are expected to be 17%, plus or minus 1%, excluding any discrete items.

Going back to the results, we will ignore the non-Data Center results which are now largely de minimus for the company, and focus on the big driver for NVDA results, where the company reported the following:

First-quarter revenue was a record $22.6 billion, up 23% from the previous quarter and up 427% from a year ago.

- Unveiled the NVIDIA Blackwell platform to fuel a new era of AI computing at trillion-parameter scale and the Blackwell-powered DGX SuperPOD™ for generative AI supercomputing.

- Announced NVIDIA Quantum and NVIDIA Spectrum™ X800 series switches for InfiniBand and Ethernet, respectively, optimized for trillion-parameter GPU computing and AI infrastructure.

- Launched NVIDIA AI Enterprise 5.0 with NVIDIA NIM inference microservices to speed enterprise app development.

- Announced TSMC and Synopsys are going into production with NVIDIA cuLitho to accelerate computational lithography, the semiconductor manufacturing industry’s most compute-intensive workload.

- Announced that nine new supercomputers worldwide are using Grace Hopper Superchips to ignite new era of AI supercomputing.

- Unveiled that Grace Hopper Superchips power the top three machines on the Green500 list of the world’s most energy-efficient supercomputers.

- Expanded collaborations with AWS, Google Cloud, Microsoft and Oracle to advance generative AI innovation.

- Worked with Johnson & Johnson MedTech to bring AI capabilities to support surgery.

If all that was not enough to send the stock soaring to all time highs, this shoudl seal the deal: the company also announced a 10 for 1 stock split, which guarantees that in a few weeks time, all retail investors will be piling into the suddenly "cheaper" stock.

And with all that, it's hardly a surprise that the stock is surging after hours, and is up about 4% trading in the mid $970s having earlier nearly jumped above $1,000 to a new all time high.

And while the company may not hit 4 digits after the close, it's just a matter of days if not hours before it does just that.

As discussed in our preview, Nvidia has been called the mother of all earnings -- the "single most important stock on the planet" according to Goldman - and for good reason: it accounts for 5% of the S&P. This morning, Mizuho’s desk analyst even said “they are the market in AI in many respects.”

So intense is the interest in today’s print that according to Bloomberg, some investors and onlookers I’ve heard from are making assessments of Jensen Huang’s body language when I spoke to him on Bloomberg Television in Las Vegas on Monday. They want any and all clues about whether this is going to go well. My conclusion from that conversation: Nvidia knows it needs to make sales beyond just cloud providers and is seeking fortune in enterprise and government markets (with help from Dell).

So with that preamble for what may be the most important earnings release this quarter, if not this year, here is what NVDA just reported for Q1:

- Revenue $26.04 billion (up from $7.19 billion y/y) and destroying estimates of $24.69 billion

- Data center revenue $22.6 billion vs. $4.28 billion y/y, smashing estimates of $21.13 billion. This is the all important one

- Professional Visualization revenue $427 million, +45% y/y, missing estimates of $479.1 million

- Automotive revenue $329 million, +11% y/y, beating estimates of $292.4 million

- Adjusted gross margin 78.9% vs. 66.8% y/y, blowing away estimates of 77%

- R&D expenses $2.72 billion, +45% y/y, in line with estimate $2.73 billion

- Adjusted operating expenses $2.50 billion, +43% y/y, in line with estimates of $2.51 billion

- Adjusted operating income $18.06 billion vs. $3.05 billion y/y, crushing estimates of $16.46 billion

- Free cash flow $14.94 billion vs. $2.64 billion y/y, estimate $12.29 billion

While the company blew away Q1 expectations, attention was on Q2 and specifically the revenue bogey where we said earlier $28BN was the magical number that would determine if the stock would plunge or soar. Well, not surprisingly, here is what NVDA just previewed for the second quarter:

- Revenue is expected to be $28.0 billion, plus or minus 2%.

Or right on the screws, and judging by the company's track record, that "plus or minus" will be a "plus", so realistically we are looking at almost $29 billion! Here is the only chart that matters.

Other guidance for Q2 and full year was the following:

- GAAP and non-GAAP gross margins are expected to be 74.8% and 75.5% (+/- 50 basis points). For the full year, gross margins are expected to be in the mid-70% range.

- GAAP and non-GAAP operating expenses are expected to be approximately $4.0 billion and $2.8 billion, respectively. Full-year operating expenses are expected to grow in the low-40% range.

- GAAP and non-GAAP other income and expense are expected to be an income of approximately $300 million, excluding gains and losses from non-affiliated investments.

- GAAP and non-GAAP tax rates are expected to be 17%, plus or minus 1%, excluding any discrete items.

Going back to the results, we will ignore the non-Data Center results which are now largely de minimus for the company, and focus on the big driver for NVDA results, where the company reported the following:

First-quarter revenue was a record $22.6 billion, up 23% from the previous quarter and up 427% from a year ago.

- Unveiled the NVIDIA Blackwell platform to fuel a new era of AI computing at trillion-parameter scale and the Blackwell-powered DGX SuperPOD™ for generative AI supercomputing.

- Announced NVIDIA Quantum and NVIDIA Spectrum™ X800 series switches for InfiniBand and Ethernet, respectively, optimized for trillion-parameter GPU computing and AI infrastructure.

- Launched NVIDIA AI Enterprise 5.0 with NVIDIA NIM inference microservices to speed enterprise app development.

- Announced TSMC and Synopsys are going into production with NVIDIA cuLitho to accelerate computational lithography, the semiconductor manufacturing industry’s most compute-intensive workload.

- Announced that nine new supercomputers worldwide are using Grace Hopper Superchips to ignite new era of AI supercomputing.

- Unveiled that Grace Hopper Superchips power the top three machines on the Green500 list of the world’s most energy-efficient supercomputers.

- Expanded collaborations with AWS, Google Cloud, Microsoft and Oracle to advance generative AI innovation.

- Worked with Johnson & Johnson MedTech to bring AI capabilities to support surgery.

If all that was not enough to send the stock soaring to all time highs, this shoudl seal the deal: the company also announced a 10 for 1 stock split, which guarantees that in a few weeks time, all retail investors will be piling into the suddenly "cheaper" stock.

And with all that, it's hardly a surprise that the stock is surging after hours, and is up about 4% trading in the mid $970s having earlier nearly jumped above $1,000 to a new all time high.

And while the company may not hit 4 digits after the close, it's just a matter of days if not hours before it does just that.