By Seth Carpenter, Managing Director and Chief Global Economist at Morgan Stanley, and Matthew Hornbach, Global Head of Macro Strategy at Morgan Stanley

Japan in Rome

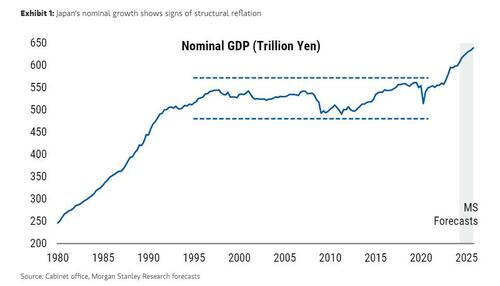

Last month at our annual Fixed Income CIO conference, one of the liveliest sessions was on Japan’s reflation. The BoJ ending negative rates and normalizing policy for the first time in eight years marked the end of decades of a deflationary equilibrium. Nominal GDP growth hit 5.7%Y in 2023, and our Japan team forecasts that Japan’s nominal GDP growth will remain above 3%Y across our forecast horizon. Nominal growth tends to translate into earnings, and so it is no surprise that our equity strategy team remains bullish, with a target for the TOPIX of 2,800.

Our baseline forecast is that the BoJ hikes rates in July this year, a view that has been reinforced by recent communications from Governor Ueda. Because we think inflation will stabilize and drift lower, we look for only one more hike after that, in 1Q25. We think the risks are to the upside for policy, if inflation doesn’t drift down the way we expect.

The falling value of the yen prompted intense market focus and ultimately intervention by the MoF. Since the exchange rate directly affects import prices (after all, 90% of energy is imported in Japan), the risks to inflation cannot be ignored when the currency moves. Our baseline view is that the yen will appreciate through the end of this year and into next year, partly based on our view that the Fed will cut rates by 75bp this year and 100bp next year. If we are wrong, and the yen continues to weaken, further intervention seems plausible and would also increase the risks of more hikes by the BoJ than in our baseline forecast.

Of course, the exchange rate is only one factor. Governor Ueda also emphasized a so-called "second force" driving inflation, the virtuous cycle between wages and prices. We remain convinced that the cycle is intact, even if the empirical outcome remains a question. We are in the middle of a fundamental shift in equilibria. The labor market is tight and tightening; the spring wage negotiations resulted in a substantial 5.2% rise, including a base wage increase of 3.6%. Domestic and foreign demand remain strong.

The strong macro backdrop and the BoJ’s shift to a hiking campaign have coincided with a sell-off in sovereign curves around the world. The 10-year JGB almost touched 1% in November, and after retracing it is now looking to test similar highs. Our baseline is that the yield returns to 1% by the end of this year. However, our bear case has a more notable sell-off, possibly to as high as 1.25%, by year-end, if inflation dynamics point to more persistence, building in a steeper curve along with more rate hikes.

While the forecast may not be crystal clear – forecasting is hard, as the saying goes, especially about the future – that fact that Japan is undergoing a fundamental shift should now be clear. Before Covid, it would have strained credulity to say that Japan would be a focus of macro investors around the world. The fact that it was one of the most heated discussions at our conference in Rome shows just how much the world has changed. When in Rome, do as the Romans do.

By Seth Carpenter, Managing Director and Chief Global Economist at Morgan Stanley, and Matthew Hornbach, Global Head of Macro Strategy at Morgan Stanley

Japan in Rome

Last month at our annual Fixed Income CIO conference, one of the liveliest sessions was on Japan’s reflation. The BoJ ending negative rates and normalizing policy for the first time in eight years marked the end of decades of a deflationary equilibrium. Nominal GDP growth hit 5.7%Y in 2023, and our Japan team forecasts that Japan’s nominal GDP growth will remain above 3%Y across our forecast horizon. Nominal growth tends to translate into earnings, and so it is no surprise that our equity strategy team remains bullish, with a target for the TOPIX of 2,800.

Our baseline forecast is that the BoJ hikes rates in July this year, a view that has been reinforced by recent communications from Governor Ueda. Because we think inflation will stabilize and drift lower, we look for only one more hike after that, in 1Q25. We think the risks are to the upside for policy, if inflation doesn’t drift down the way we expect.

The falling value of the yen prompted intense market focus and ultimately intervention by the MoF. Since the exchange rate directly affects import prices (after all, 90% of energy is imported in Japan), the risks to inflation cannot be ignored when the currency moves. Our baseline view is that the yen will appreciate through the end of this year and into next year, partly based on our view that the Fed will cut rates by 75bp this year and 100bp next year. If we are wrong, and the yen continues to weaken, further intervention seems plausible and would also increase the risks of more hikes by the BoJ than in our baseline forecast.

Of course, the exchange rate is only one factor. Governor Ueda also emphasized a so-called "second force" driving inflation, the virtuous cycle between wages and prices. We remain convinced that the cycle is intact, even if the empirical outcome remains a question. We are in the middle of a fundamental shift in equilibria. The labor market is tight and tightening; the spring wage negotiations resulted in a substantial 5.2% rise, including a base wage increase of 3.6%. Domestic and foreign demand remain strong.

The strong macro backdrop and the BoJ’s shift to a hiking campaign have coincided with a sell-off in sovereign curves around the world. The 10-year JGB almost touched 1% in November, and after retracing it is now looking to test similar highs. Our baseline is that the yield returns to 1% by the end of this year. However, our bear case has a more notable sell-off, possibly to as high as 1.25%, by year-end, if inflation dynamics point to more persistence, building in a steeper curve along with more rate hikes.

While the forecast may not be crystal clear – forecasting is hard, as the saying goes, especially about the future – that fact that Japan is undergoing a fundamental shift should now be clear. Before Covid, it would have strained credulity to say that Japan would be a focus of macro investors around the world. The fact that it was one of the most heated discussions at our conference in Rome shows just how much the world has changed. When in Rome, do as the Romans do.