Michael Sonnenshein has stepped down from his role as the CEO of Grayscale Investments, the WSJ reported.

“I would like to thank Barry Silbert for his vision and partnership and for entrusting me to lead Grayscale’s business. The crypto asset class is at an important inflection point and this is the right moment for a smooth transition”, Sonnenshein said on his way out.

He will be replaced by Peter Mintzberg - who currently serves as the global head of strategy for Goldman Sachs’s asset and wealth management division - on August 15, according to Barry Silbert, founder and CEO of Digital Currency Group, Grayscale's parent company.

2/ I want to thank @Sonnenshein- during his 10 years @Grayscale, Michael guided the firm through exponential growth & oversaw its pivotal role in bringing spot bitcoin ETFs to market, leading the way for the broader financial industry. We wish him the best in his future endeavors

— Barry Silbert (@BarrySilbert) May 20, 2024

Silbert recruited Sonnenshein in 2013 to help raise assets for GBTC, which had only $60 million at the time. In the early days, the duo would go on roadshows to pitch the fund to traditional finance professionals only to have the meetings canceled in the wake of negative headlines about bitcoin, Sonnenshein recalled earlier this year.

“There were definitely times when we would have been allocated 45 minutes to a meeting and very quickly into a meeting, we would find we weren’t capturing people’s attention,” he said in a March interview, adding that a “palpable passion for crypto and bitcoin” kept them going despite the setbacks.

His replacement, Mintzberg - whose 20-year ETF-focused Wall Street career spans BlackRock, OppenheimerFunds and Invesco - said that he has "long admired Grayscale’s position as the leading crypto asset management firm, and I am honored to join the most talented and pioneering team in the business. This is an exciting time in Grayscale’s history as it continues to capitalize on the unprecedented momentum in the asset class.”

Mintzberg will take control of Grayscale during a very challenging period: for years, the Grayscale Bitcoin Trust, or GBTC, was one of the few ways for investors to bet on bitcoin in their brokerage accounts without buying the cryptocurrency itself. This privileged position helped the trust, known by its GBTC ticker symbol, amass more than $40 billion in assets under management at its peak in November 2021.

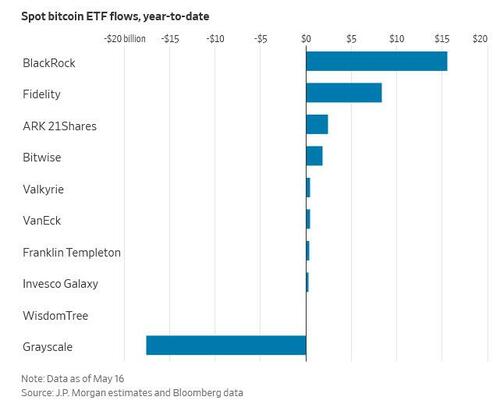

However, in recent months Grayscale’s bitcoin fund has experienced a reversal of fortune, with investors pulling more than $17 billion since it converted into an exchange-traded fund in January. In contrast, nine newly launched bitcoin ETFs from Wall Street asset managers such as BlackRock and Fidelity Investments have attracted more than $30 billion in inflows. The simplest reason for that is that while GBTC charges a 1.5% fee, all other bitcoin ETFs charge next to nothing.

Ironically, Grayscale is largely responsible for the long-awaited regulatory approval of spot bitcoin ETFs - those that hold bitcoin directly, instead of via futures contracts, as previous products did, and in doing so it has seen its own bitcoin holdings shrink by more than half since the launch of the spot bitcoin ETF industry on January 10.

The company sued the SEC in 2022 after the agency rejected its previous bid to turn its bitcoin trust into an ETF. The SEC greenlighted the mass launch of the funds in January after repeatedly rejecting the applications on the basis that the underlying market was susceptible to fraud. When approving the new funds, SEC Chair Gary Gensler said the court ruling in Grayscale’s favor had compelled the change.

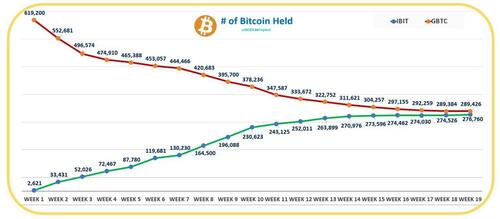

While Grayscale’s GBTC is the largest ETF by on-chain Bitcoin investments, currently holding over 287,801 BTC, worth $19.3 billion and holding a 34.9% market share, due to its staggering 1.5% annual fee (compared to the industry standard of 0.20% to 0.25%) it continues to bleed bitcoins daily which get relocated to cheaper alternatives.

In comparison, BlackRock’s iShares ETF (IBIT) is the second-largest, holding over 274,000 BTC, worth $18.4 billion, and having a 33.3% market share, according to Dune. It is only a matter of time before IBIT surpasses GBTC in total holdings.

Sonnenshein previously said that he wasn’t worried about the investor exodus and suggested that GBTC’s fee would come down as the market matures, however judging by the unexpected departure, he was actually worried.

That said, despite the constantly outflows, Grayscale continues to generate robust revenue thanks to a sharp rise in crypto prices and the high fees charged by its bitcoin ETF. In the first quarter, Grayscale generated $156 million in revenue, accounting for more than half of DCG’s $229 million total, according to DCG’s first-quarter investor letter.

Grayscale Chief Financial Officer Edward McGee will lead the company as principal executive officer until August.

Michael Sonnenshein has stepped down from his role as the CEO of Grayscale Investments, the WSJ reported.

“I would like to thank Barry Silbert for his vision and partnership and for entrusting me to lead Grayscale’s business. The crypto asset class is at an important inflection point and this is the right moment for a smooth transition”, Sonnenshein said on his way out.

He will be replaced by Peter Mintzberg - who currently serves as the global head of strategy for Goldman Sachs’s asset and wealth management division - on August 15, according to Barry Silbert, founder and CEO of Digital Currency Group, Grayscale's parent company.

2/ I want to thank @Sonnenshein- during his 10 years @Grayscale, Michael guided the firm through exponential growth & oversaw its pivotal role in bringing spot bitcoin ETFs to market, leading the way for the broader financial industry. We wish him the best in his future endeavors

— Barry Silbert (@BarrySilbert) May 20, 2024

Silbert recruited Sonnenshein in 2013 to help raise assets for GBTC, which had only $60 million at the time. In the early days, the duo would go on roadshows to pitch the fund to traditional finance professionals only to have the meetings canceled in the wake of negative headlines about bitcoin, Sonnenshein recalled earlier this year.

“There were definitely times when we would have been allocated 45 minutes to a meeting and very quickly into a meeting, we would find we weren’t capturing people’s attention,” he said in a March interview, adding that a “palpable passion for crypto and bitcoin” kept them going despite the setbacks.

His replacement, Mintzberg - whose 20-year ETF-focused Wall Street career spans BlackRock, OppenheimerFunds and Invesco - said that he has "long admired Grayscale’s position as the leading crypto asset management firm, and I am honored to join the most talented and pioneering team in the business. This is an exciting time in Grayscale’s history as it continues to capitalize on the unprecedented momentum in the asset class.”

Mintzberg will take control of Grayscale during a very challenging period: for years, the Grayscale Bitcoin Trust, or GBTC, was one of the few ways for investors to bet on bitcoin in their brokerage accounts without buying the cryptocurrency itself. This privileged position helped the trust, known by its GBTC ticker symbol, amass more than $40 billion in assets under management at its peak in November 2021.

However, in recent months Grayscale’s bitcoin fund has experienced a reversal of fortune, with investors pulling more than $17 billion since it converted into an exchange-traded fund in January. In contrast, nine newly launched bitcoin ETFs from Wall Street asset managers such as BlackRock and Fidelity Investments have attracted more than $30 billion in inflows. The simplest reason for that is that while GBTC charges a 1.5% fee, all other bitcoin ETFs charge next to nothing.

Ironically, Grayscale is largely responsible for the long-awaited regulatory approval of spot bitcoin ETFs - those that hold bitcoin directly, instead of via futures contracts, as previous products did, and in doing so it has seen its own bitcoin holdings shrink by more than half since the launch of the spot bitcoin ETF industry on January 10.

The company sued the SEC in 2022 after the agency rejected its previous bid to turn its bitcoin trust into an ETF. The SEC greenlighted the mass launch of the funds in January after repeatedly rejecting the applications on the basis that the underlying market was susceptible to fraud. When approving the new funds, SEC Chair Gary Gensler said the court ruling in Grayscale’s favor had compelled the change.

While Grayscale’s GBTC is the largest ETF by on-chain Bitcoin investments, currently holding over 287,801 BTC, worth $19.3 billion and holding a 34.9% market share, due to its staggering 1.5% annual fee (compared to the industry standard of 0.20% to 0.25%) it continues to bleed bitcoins daily which get relocated to cheaper alternatives.

In comparison, BlackRock’s iShares ETF (IBIT) is the second-largest, holding over 274,000 BTC, worth $18.4 billion, and having a 33.3% market share, according to Dune. It is only a matter of time before IBIT surpasses GBTC in total holdings.

Sonnenshein previously said that he wasn’t worried about the investor exodus and suggested that GBTC’s fee would come down as the market matures, however judging by the unexpected departure, he was actually worried.

That said, despite the constantly outflows, Grayscale continues to generate robust revenue thanks to a sharp rise in crypto prices and the high fees charged by its bitcoin ETF. In the first quarter, Grayscale generated $156 million in revenue, accounting for more than half of DCG’s $229 million total, according to DCG’s first-quarter investor letter.

Grayscale Chief Financial Officer Edward McGee will lead the company as principal executive officer until August.