US futures are flat, reversing earlier losses, with European bourses and Asian markets all lower as the international risk-off tone carries over to the US pre-mkt, likely driven by a desire to see the NVDA print before determining near-term direction. Until then, markets are hunting for catalysts and drifting as they wait, with US stock futures unchanged as of 7:00am, and Nasdaq futures down 0.1%. Bonds caught a bid with yields down 2-3bps across the curve, pressuring USD. Commodities are also lower with weakness across all three complexes but with some safety being found in base metals: oil prices are a little lower, while copper and gold prices have slipped a little from the records they notched up.The macro focus will be on Fedspeak with yesterday’s batch of Fed speakers, not market-moving. From a micro perspective, Day 2 of the JPM TMT Conference will be the focus.

In premarket trading, NVDA was +36bps higher ahead of its earnings tomorrow, while Mag7 names are mostly lower and Semis are trading slightly lower. Palo Alto Networks shares dropped 7.9% after the security software company issued a disappointing forecast for 4Q billings. The company also reported 3Q results, which were in line with consensus, but below the higher buyside expectations, according to Morgan Stanley. Here are some other notable premarket movers:

- Global-e Online shares gain 2.3% after the application software company was upgraded to overweight from equal-weight at Morgan Stanley, which expressed optimism on the firm’s ability to execute on a planned acceleration in the second half of the year.

- Larimar Therapeutics shares jump 18% after the biotech company said the FDA has removed a partial clinical hold on its nomlabofusp program. The drug is a treatment for patients with Friedreich’s ataxia, a neurological disorder. William Blair analysts called the removal “great news.”

- Zoom Video Communications shares decline 2.0% after the video-conferencing software company gave a second-quarter forecast for adjusted earnings that was weaker than expected. Additionally, the firm also reported first-quarter results that beat expectations.

Before tomorrow's Fed minutes - which will be the day's other main event aside from Nvidia - there are still plenty of speakers from the central bank to come. Yesterday, Loretta Mester said that three interest rate cuts in 2024 is no longer appropriate and reiterated that policymakers need more data before making a decision, even adding she’d be open to a rate hike if warranted. Raphael Bostic, Thomas Barkin, John Williams and Christopher Waller continue the run of speakers on Tuesday.

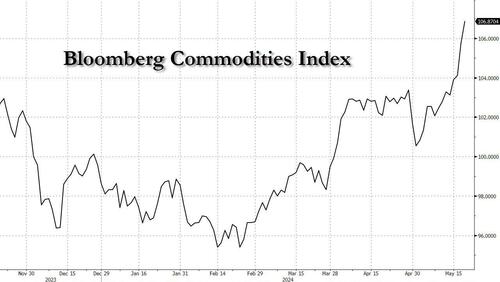

And speaking of inflation, investors continued to monitor commodity prices, after the Bloomberg Commodity Spot Index reached its highest level since January 2023, while gold, silver and copper changed hands near records. However, the commodity surge has so far failed to derail conviction that inflation will keep easing, allowing the Federal Reserve and other major central banks to cut interest rates this year.

“The latest batch of growth, inflation, and Fed data has provided the macro support for the markets to keep grinding higher. Nvidia’s 1Q24 earnings this week could boost the micro AI tailwind,” Jason Draho at UBS Financial Services Inc. said in a note.

European equities dropped Tuesday, pulling back from recent record highs, as investors retreated to the sidelines to await results this week from Nvidia Corp. The Stoxx 600 index slipped 0.4%, with drugmaker GSK Plc among the losers as it faced a whistleblower lawsuit that could cost it billions of dollars.

Earlier, Chinese shares slipped and a broader Asian equity gauge fell after seven days of gains with Hong Kong stocks leading declines as Tencent suspended a new game within hours of its China debut. Hong Kong’s tech subindex slides more than 3% while the benchmark gives up 2%. Data also showed little sign of a turnaround in China’s debt-plagued property sector, with local governments reaping the least revenue in eight years through land sales.

In FX, the Bloomberg Dollar Spot Index erases an earlier advance to fall about 0.1% with NOK and SEK outperforming; investors are focusing on the US interest-rate differential relative to the rest of the developed world. “This may have to do with lackluster trading in the absence of fresh catalysts — some dollar shorts were taken off the table,” said Christopher Wong, strategist at Oversea-Chinese Banking Corp. “Further USD weakness would require softer US data and there isn’t much tier-1 data this week.”

In rates, bonds rise, with 10-year gilts outperforming comparable Treasuries and bunds. US yields richer by 1.5bp to 2.5bp across the curve with belly-led gains steepening 5s30s spread by almost 1bp on the day; 10-year yields around 4.425% with bunds lagging slightly and gilts mildly outperforming in the sector. US sales this week include $16b 20-year bonds Wednesday and a $16b 10-year TIPS reopening Thursday. US session lacks scheduled data, leaving focus on another heavy dose of Fed speakers.

Commodities consolidate with gold and copper trading lower after recent highs; the Bloomberg Commodity Spot Index reaches highest level since January 2023. Spot gold falls roughly $7 to trade near $2,418/oz. Brent and WTI test support from short-term moving averages as they decline. Base metals are mixed; LME nickel falls 0.4% while LME aluminum gains 1.5%.

In crypto, Crypto prices surged on signs of momentum toward US approval of exchange-traded funds investing directly in second-largest token Ether. CoinDesk reported that exchanges that want to list spot Ether ETFs are abruptly being asked by regulators to update key filings related to these products, according to three people familiar with the matter which suggests regulators may be moving to approve these applications ahead of Thursday's deadline.

Looking to the day ahead, US economic data this session includes May Philadelphia Fed non-manufacturing activity at 8:30am. Central bank speakers include ECB President Lagarde, the Fed’s Barkin, Waller, Williams, Bostic, Barr, Collins and Mester, along with BoE Governor Bailey.

Market Snapshot

- S&P 500 futures little changed at 5,331.25

- STOXX Europe 600 down 0.4% to 521.77

- MXAP down 0.7% to 181.07

- MXAPJ down 0.9% to 566.85

- Nikkei down 0.3% to 38,946.93

- Topix down 0.3% to 2,759.72

- Hang Seng Index down 2.1% to 19,220.62

- Shanghai Composite down 0.4% to 3,157.97

- Sensex up 0.1% to 74,081.70

- Australia S&P/ASX 200 down 0.2% to 7,851.68

- Kospi down 0.7% to 2,724.18

- German 10Y yield little changed at 2.51%

- Euro little changed at $1.0861

- Brent Futures down 0.9% to $82.99/bbl

- Gold spot down 0.4% to $2,416.23

- US Dollar Index little changed at 104.59

Top Overnight News

- Alibaba Group Holding Ltd. slashed prices for a clutch of artificial intelligence services by as much as 97%, spurring an immediate response from Baidu Inc. in potentially the start of a price war in China’s nascent AI market. BBG

- ASML and TSMC reassured US officials they have ways to disable the world’s most sophisticated chipmaking machines remotely should China invade Taiwan, people familiar said. The Dutch company can activate a shut-off that would act as a kill switch for its EUVs. BBG

- Apple challenged a €1.8 billion fine levied by the EU for thwarting fair competition from music-streaming rivals including Spotify, people familiar said. BBG

- UK grocery inflation fell to near its historical average in May, bringing some relief to consumers hit by the cost of living crisis since 2021, according to sector data. Grocery price annual inflation dropped to 2.4 per cent in the four weeks to mid-May, down from 3.2 per cent last month and the lowest since October 2021, research company Kantar said on Tuesday. The figure was also only 0.8 percentage points higher than the average of 1.6 per cent in the 10 years to 2021, which is just before prices began to climb. FT

- Iran’s aerospace infrastructure has been hobbled by decades of sanctions, making its helicopters increasingly precarious. FT

- Fed officials acknowledged the progress in Apr’s CPI but warned against reading too much into a single number and said the battle against elevated inflation still has a ways to go. RTRS

- The Trump campaign and RNC reported that they jointly raised $76 million in April, about $25 million more than the Biden campaign said it raised across all its committees over the same period. Trump’s reported fundraising haul came as the former president was personally contacting high-dollar donors and encouraging them to give the maximum amount of more than $800,000 to the Trump 47 Committee, which he formed in March to merge fundraising forces with the RNC. WaPo

- Tencent suspended its hotly anticipated Dungeon & Fighter Mobile game within an hour of its China debut due to server glitches. Nintendo bought Shiver studio to help add games for its next Switch console. BBG

- MSFT may be closely aligned with ChatGPT, but the software giant is working on myriad AI initiatives both internally and with a slew of non-OpenAI external partners because at the end of the day it doesn’t necessarily care which model customers select, so long as they’re being run on Azure. Fortune

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were subdued following the somewhat indecisive performance on Wall St where price action was choppy amid a lack of catalysts and as participants await this week's key risk events. ASX 200 was lower as losses in materials and mining stocks offset the tech outperformance. Nikkei 225 was lifted at the open owing to recent currency weakness but then steadily gave back all of its initial gains alongside the downbeat risk appetite across most of its regional peers. Hang Seng and Shanghai Comp declined with underperformance in Hong Kong amid tech losses and with Li Auto shares down nearly 20% on weak earnings, while the mainland also conformed to the risk-averse mood albeit with downside limited by quiet newsflow.

Top Asian News

- Japanese Finance Minister Suzuki said a weak yen has positive and negative aspects, while he noted that at this point, they are concerned about the negative aspects of a weak yen and closely watching FX moves. Furthermore, Suzuki said they will deal appropriately as needed on forex and that it is desirable for forex to move in a stable manner, according to Reuters.

- RBA Minutes from the May 6th-7th meeting stated they considered whether to raise rates but judged the case for steady policy was the stronger one and the Board agreed it was difficult to either rule in or rule out future changes in the Cash Rate. RBA stated the flow of data had increased risks of inflation staying above target for longer and the Board expressed limited tolerance for inflation returning to target later than 2026, while a rate rise could be appropriate if forecasts proved overly optimistic and risks around forecasts were judged to be balanced.

- Carlyle has launched a new Japanese fund worth JPY 430bln (it's largest ever), according to the Nikkei

European bourses, Stoxx600 (-0.4%) opened on a softer footing and continued to trundle lower throughout the European morning. European sectors are mostly lower; Healthcare takes the top spot, led higher by gains in AstraZeneca (+1.5%) after outlining its 2030 plan, while giants Novo Nordisk, Roche, and Novartis resume trade after the Whit Monday holiday. US Equity Futures (ES U/C, NQ -0.1%, RTY -0.2%) are flat/modestly lower amid a lack of catalysts and after yesterday's indecisive Wall Street session.

Top European News

- EU's von der Leyen suggested making access to EU subsidies conditional on economic reforms as a potential method to improve the bloc's competitiveness, according to FT.

- Kantar UK Grocery Market Share: Grocery price inflation has also fallen for the fifteenth month in a row to 2.4%, the lowest level since October 2021.

- ASML (ASML NA) and TSMC (2330 TT) can disable chip machines if China invades Taiwan, according to Bloomberg

FX

- USD is incrementally softer vs. peers with DXY respecting yesterday's 104.39-79 range. A slew of Fed speakers may help to guide further price action.

- EUR is slightly firmer vs the Dollar, due to broader Dollar weakness rather than fresh EZ catalysts. After failing to recently launch a test of 1.09, the pair has since drifted lower with today's 1.0852 trough.

- GBP gains modestly vs. the USD. Focus for the GBP remains on Wednesday's inflation metrics, which could sway pricing for the June meeting. For now, Cable remains contained within yesterday's 1.2690-1.2726 range.

- USD/JPY near the unchanged mark after a bout of selling pressure in early European trade (not driven by any obvious catalyst) dragged the pair back from its overnight peak at 156.54. The pair is currently consolidating on a 156 handle awaiting fresh impetus.

- Antipodeans are both flat vs. the USD in quiet newsflow. AUD/USD unfazed by RBA minutes overnight but has made a fresh low at 0.6647 following yesterday's session of losses.

- CAD steady vs. the USD ahead of upcoming inflation data. ING posits that if the BoC's preferred core gauge (“median”) came in below 3.0%, that would "place all key inflation measures, core and headline, within the 1-3% inflation target band.

- PBoC set USD/CNY mid-point at 7.1069 vs exp. 7.2366 (prev. 7.1042).

Fixed Income

- USTs are flat trade with the recent slew of Fed speakers unable to have any meaningful sway on price action in what has been a quiet start to the week. For now, the Jun'24 contract is holding above the 109 mark and within yesterday's 108.30+-109.09 range.

- Bunds are leading peers in the wake of slightly softer-than-expected German PPI metrics. Price action could also be seen as an inevitable bounce following losses endured since last Thursday. Jun'24 Bund has recovered to circa 130.86 after basing out yesterday at 130.47. Modest downticks were seen on the Q1 EZ labour cost increase, with no reaction seen to the Bund auction.

- Gilts are firmer on the session but to a lesser extent than its German peer, and overall unreactive to a well-received Gilt auction. For now, Gilts are tucked within yesterday's 97.50-98.01 range.

- UK sells GBP 2.25bln 4.75% 2043 Gilt: b/c 3.67x (prev. 3.67x), average yield 4.580% (prev. 4.495%) & 0.4bps (prev. 0.1bps tail).

- Germany sells EUR 3.33 vs exp. EUR 4bln 2.10% 2029 Bobl: b/c 2.8x (prev. 2.6x), average yield 2.56% (prev. 2.41%) & retention 16.75% (prev. 18.25%)

Commodities

- Another downbeat session for the crude complex after July futures settled lower by around USD 0.30/bbl apiece in choppy trade; Brent July resides towards to bottom end of a current USD 82.81-83.76/bbl intraday range.

- Downbeat trade across precious metals as prices continue to pull back despite quiet newsflow but amid a lack of major geopolitical updates/escalations. XAU trades in the middle of a USD 2,406.16-2,433.14/oz intraday band.

- Base metals are mixed after the complex extended its rally yesterday, with copper prices breaking above USD 11,000/t and hitting record highs.

- Chinese April crude iron output +11.5% Y/Y at 87.90mln metric tons, according to the stats bureau; refined copper output +9.2%, lead +1.1% Y/Y, zinc -0.8% Y/Y

Geopolitics

- Israeli media on a source said National Security Advisor "Sullivan after meeting Netanyahu felt there was no strategy to end the war", via Al Arabiya

- "Israel has decided to shelve plans for a major offensive in the Gaza Strip’s southern city of Rafah, and will act in a more limited manner in the city, after discussions with the US on the matter", via Times of Israel citing WaPo analyst's sources.

- Yemen's Houthis said they have downed a US drone over the Baydaa Province, according to a statement

- US President Biden said what's happening in Gaza is not genocide and the US wants Hamas beaten, according to Reuters and Times of Israel.

- Deputy US Representative said the US proposed alternatives to a major ground offensive in Rafah and believes it will better advance Israel's goal, according to Al Jazeera.

- US top general said they are confident Ukraine has not used long-range US weaponry inside of Russia.

Econ Data

- 08:30: May Philadelphia Fed Non-Manufactu, prior -12.4

Central Bank speakers

- 04:00: Yellen, ECB’s Lagarde, Germany’s Lindner Speak

- 09:00: Fed’s Barkin Gives Welcome Remarks

- 09:00: Fed’s Waller Discusses US Economy

- 09:05: Fed’s Williams Gives Opening Remarks

- 09:10: Fed’s Bostic Offers Brief Welcome Remarks

- 11:45: Fed’s Barr Speaks in Fireside Chat

- 19:00: Fed’s Bostic Moderates Panel with Collins and Mester

DB's Jim Reid concludes the overnight wrap

In 16 plus years of writing the EMR it's usually finished off in the dark and with a very strong coffee. Today is one of those rare occasions where I hand over the reins whilst looking out over the ocean and with a cold refreshing drink.

Markets have started the week as becalmed as the Pacific Ocean looks as I type this, with the S&P 500 (+0.09%) consolidating less than a thousandth of a percent below last week’s all-time high ahead of Nvidia’s results tomorrow. Investors have grown more positive about a soft landing in the last couple of weeks, after having some doubts in April when the S&P 500 fell -4.16%. So far in May the index is up +5.41% (+11.29% YTD), with Nvidia’s +91.4% gain accounting for a quarter of its YTD rise. So as it stands, the S&P is on track for its strongest monthly gain since November. Markets are seemingly satisfied that inflation isn’t continuing to accelerate even if it’s notably higher than expected at the start of 2024. For example, back at the start of January the Bloomberg consensus for Q2 2024 headline US CPI inflation was at 2.7%. That forecast is now 3.4%. Q4 forecasts have gone up half a percentage point to 2.9%.

The market has instead focused on accommodative financial conditions, broadly resilient growth, a decent earnings season, inflation trending lower (even if not nearly as much as thought at the start of the year), and Fed cuts just being delayed rather than not happening. It would have been interesting to poll investors at the start of the year as to where they would have thought markets would be today had they known where inflation would have printed so far in 2024. So that combination probably would have been predicted by very few.

The rouge inflation prints haven't dented the soft landing optimism and this got some support from Fed speakers yesterday. In particular, Vice Chair Jefferson described the April inflation data as “encouraging”, and Vice Chair for Supervision Barr said that “I think we are in a good position to hold steady and closely watch how conditions evolve.” Such patience was also visible from San Francisco Fed President Daly who noted there was no “urgency” to adjust rates, while Cleveland Fed President Mester stated that “It’s too soon to tell what path inflation is on”. So similar to Powell’s recent comments, senior Fed officials are in no rush to think about rate cuts but are certainly not reacting that hawkishly to the latest inflation data either. Pricing of Fed rate cuts by year end fell by -3.1bps to 41bps yesterday, back to levels seen early last week before the April CPI print (having peaked at 52bps after the release). The next important date in the diary is on May 31, when we’ll get the full PCE inflation numbers for April, which is what they officially target.

There is another big round of central bank speakers today including the ECB's President Lagarde, the Fed’s Barkin, Waller, Williams, Bostic, Barr, Collins and Mester, along with BoE Governor Bailey.

With Fed officials sounding patient yesterday, it was a slower but generally positive day for equities. The S&P 500 (+0.09%) finished the day a hair's breadth below last week’s record high, having traded above it for much of the session. Tech outperformance did see the NASDAQ (+0.65%) and the Magnificent 7 (+0.43%) close at record highs, with Nvidia (+2.49%) leading the way ahead of its announcement tomorrow. Banks (-2.53%) underperformed within the S&P 500, led by JPMorgan (-4.50%) following comments by CEO Jamie Dimon that “We’re not going to buy back a lot of stock at these prices” and that a succession plan is “well on the way”.

Over in Europe it was a similar story, with the STOXX 600 (+0.18%) closing just shy of its record high from last week. Italy’s FTSE MIB index underperformed (-1.62%) but much of its decline came due to ex dividend date effects. The story was one of moderate gains elsewhere on the continent, including from the DAX (+0.35%), the CAC 40 (+0.35%) and the IBEX 35 (+0.10%).

Although most equities generally just missed out on new highs, gold prices (+0.47%) closed at a record high of $2,427/oz as investors continued to anticipate rate cuts this year. Separately, the iTraxx Crossover in Europe (-3.0bps) closed at its tightest level in over two years.

That sense that rate cuts were coming closer into view was evident from central bank speakers in Europe. For instance, BoE Deputy Governor Broadbent said in a speech that “ it’s possible Bank Rate could be cut some time over the summer.” And at the ECB, Latvia’s Kazaks said that “it’s quite likely June is going to be the time when we start the rate cuts”, although he did warn that the “process needs to be cautious, gradual and we should not rush.” Collectively, this supported the idea that the global monetary policy cycle was shifting towards an easing mode, although it had limited impact on market pricing. By the close overnight index swaps were pricing in a 96% chance of an ECB cut in June, and a 55% chance of a BoE cut in June (slightly down from 58% on Friday).

With this backdrop, sovereign bonds saw a modest sell off on both sides of the Atlantic. For example, yields on 10yr Treasuries were up +2.3bps to 4.445%, and those on 2yr Treasuries were up +2.4bps to 4.85%. High corporate issuance levels may have played a part. Meanwhile in Europe, yields on 10yr bunds (+1.3bps), OATs (+0.4bps) and BTPs (+0.3bps) all moved a little higher, whilst gilts saw the biggest underperformance despite Broadbent’s comments, with the 10yr yield up +4.1bps on the day.

Overnight in Asia, equity markets have lost ground across the region, with the Hang Seng (-2.05%) as the biggest underperformer amidst a decline in EV and tech stocks. Indeed, the Hang Seng TECH Index is down -3.18% this morning, putting it on track to end a run of 7 consecutive gains. Otherwise, the KOSPI (-0.58%), the Shanghai Comp (-0.41%) and the CSI 300 (-0.39%) are all negative, whilst the Nikkei (-0.04%) has also given up its earlier gains to move slightly lower. Sovereign bonds have also lost ground overnight, with the 2yr Japanese government bond yield (+0.6bps) at a post-2009 high of 0.34%. Australian government bonds lost ground as well after the minutes of the latest RBA meeting showed they had considered a rate hike. Looking forward, US equity futures are fairly stable though, with those on the S&P 500 up +0.02%.

To the day ahead now, and central bank speakers include ECB President Lagarde, the Fed’s Barkin, Waller, Williams, Bostic, Barr, Collins and Mester, along with BoE Governor Bailey. Otherwise, data releases include Canadian CPI and German PPI for April.

US futures are flat, reversing earlier losses, with European bourses and Asian markets all lower as the international risk-off tone carries over to the US pre-mkt, likely driven by a desire to see the NVDA print before determining near-term direction. Until then, markets are hunting for catalysts and drifting as they wait, with US stock futures unchanged as of 7:00am, and Nasdaq futures down 0.1%. Bonds caught a bid with yields down 2-3bps across the curve, pressuring USD. Commodities are also lower with weakness across all three complexes but with some safety being found in base metals: oil prices are a little lower, while copper and gold prices have slipped a little from the records they notched up.The macro focus will be on Fedspeak with yesterday’s batch of Fed speakers, not market-moving. From a micro perspective, Day 2 of the JPM TMT Conference will be the focus.

In premarket trading, NVDA was +36bps higher ahead of its earnings tomorrow, while Mag7 names are mostly lower and Semis are trading slightly lower. Palo Alto Networks shares dropped 7.9% after the security software company issued a disappointing forecast for 4Q billings. The company also reported 3Q results, which were in line with consensus, but below the higher buyside expectations, according to Morgan Stanley. Here are some other notable premarket movers:

- Global-e Online shares gain 2.3% after the application software company was upgraded to overweight from equal-weight at Morgan Stanley, which expressed optimism on the firm’s ability to execute on a planned acceleration in the second half of the year.

- Larimar Therapeutics shares jump 18% after the biotech company said the FDA has removed a partial clinical hold on its nomlabofusp program. The drug is a treatment for patients with Friedreich’s ataxia, a neurological disorder. William Blair analysts called the removal “great news.”

- Zoom Video Communications shares decline 2.0% after the video-conferencing software company gave a second-quarter forecast for adjusted earnings that was weaker than expected. Additionally, the firm also reported first-quarter results that beat expectations.

Before tomorrow's Fed minutes - which will be the day's other main event aside from Nvidia - there are still plenty of speakers from the central bank to come. Yesterday, Loretta Mester said that three interest rate cuts in 2024 is no longer appropriate and reiterated that policymakers need more data before making a decision, even adding she’d be open to a rate hike if warranted. Raphael Bostic, Thomas Barkin, John Williams and Christopher Waller continue the run of speakers on Tuesday.

And speaking of inflation, investors continued to monitor commodity prices, after the Bloomberg Commodity Spot Index reached its highest level since January 2023, while gold, silver and copper changed hands near records. However, the commodity surge has so far failed to derail conviction that inflation will keep easing, allowing the Federal Reserve and other major central banks to cut interest rates this year.

“The latest batch of growth, inflation, and Fed data has provided the macro support for the markets to keep grinding higher. Nvidia’s 1Q24 earnings this week could boost the micro AI tailwind,” Jason Draho at UBS Financial Services Inc. said in a note.

European equities dropped Tuesday, pulling back from recent record highs, as investors retreated to the sidelines to await results this week from Nvidia Corp. The Stoxx 600 index slipped 0.4%, with drugmaker GSK Plc among the losers as it faced a whistleblower lawsuit that could cost it billions of dollars.

Earlier, Chinese shares slipped and a broader Asian equity gauge fell after seven days of gains with Hong Kong stocks leading declines as Tencent suspended a new game within hours of its China debut. Hong Kong’s tech subindex slides more than 3% while the benchmark gives up 2%. Data also showed little sign of a turnaround in China’s debt-plagued property sector, with local governments reaping the least revenue in eight years through land sales.

In FX, the Bloomberg Dollar Spot Index erases an earlier advance to fall about 0.1% with NOK and SEK outperforming; investors are focusing on the US interest-rate differential relative to the rest of the developed world. “This may have to do with lackluster trading in the absence of fresh catalysts — some dollar shorts were taken off the table,” said Christopher Wong, strategist at Oversea-Chinese Banking Corp. “Further USD weakness would require softer US data and there isn’t much tier-1 data this week.”

In rates, bonds rise, with 10-year gilts outperforming comparable Treasuries and bunds. US yields richer by 1.5bp to 2.5bp across the curve with belly-led gains steepening 5s30s spread by almost 1bp on the day; 10-year yields around 4.425% with bunds lagging slightly and gilts mildly outperforming in the sector. US sales this week include $16b 20-year bonds Wednesday and a $16b 10-year TIPS reopening Thursday. US session lacks scheduled data, leaving focus on another heavy dose of Fed speakers.

Commodities consolidate with gold and copper trading lower after recent highs; the Bloomberg Commodity Spot Index reaches highest level since January 2023. Spot gold falls roughly $7 to trade near $2,418/oz. Brent and WTI test support from short-term moving averages as they decline. Base metals are mixed; LME nickel falls 0.4% while LME aluminum gains 1.5%.

In crypto, Crypto prices surged on signs of momentum toward US approval of exchange-traded funds investing directly in second-largest token Ether. CoinDesk reported that exchanges that want to list spot Ether ETFs are abruptly being asked by regulators to update key filings related to these products, according to three people familiar with the matter which suggests regulators may be moving to approve these applications ahead of Thursday's deadline.

Looking to the day ahead, US economic data this session includes May Philadelphia Fed non-manufacturing activity at 8:30am. Central bank speakers include ECB President Lagarde, the Fed’s Barkin, Waller, Williams, Bostic, Barr, Collins and Mester, along with BoE Governor Bailey.

Market Snapshot

- S&P 500 futures little changed at 5,331.25

- STOXX Europe 600 down 0.4% to 521.77

- MXAP down 0.7% to 181.07

- MXAPJ down 0.9% to 566.85

- Nikkei down 0.3% to 38,946.93

- Topix down 0.3% to 2,759.72

- Hang Seng Index down 2.1% to 19,220.62

- Shanghai Composite down 0.4% to 3,157.97

- Sensex up 0.1% to 74,081.70

- Australia S&P/ASX 200 down 0.2% to 7,851.68

- Kospi down 0.7% to 2,724.18

- German 10Y yield little changed at 2.51%

- Euro little changed at $1.0861

- Brent Futures down 0.9% to $82.99/bbl

- Gold spot down 0.4% to $2,416.23

- US Dollar Index little changed at 104.59

Top Overnight News

- Alibaba Group Holding Ltd. slashed prices for a clutch of artificial intelligence services by as much as 97%, spurring an immediate response from Baidu Inc. in potentially the start of a price war in China’s nascent AI market. BBG

- ASML and TSMC reassured US officials they have ways to disable the world’s most sophisticated chipmaking machines remotely should China invade Taiwan, people familiar said. The Dutch company can activate a shut-off that would act as a kill switch for its EUVs. BBG

- Apple challenged a €1.8 billion fine levied by the EU for thwarting fair competition from music-streaming rivals including Spotify, people familiar said. BBG

- UK grocery inflation fell to near its historical average in May, bringing some relief to consumers hit by the cost of living crisis since 2021, according to sector data. Grocery price annual inflation dropped to 2.4 per cent in the four weeks to mid-May, down from 3.2 per cent last month and the lowest since October 2021, research company Kantar said on Tuesday. The figure was also only 0.8 percentage points higher than the average of 1.6 per cent in the 10 years to 2021, which is just before prices began to climb. FT

- Iran’s aerospace infrastructure has been hobbled by decades of sanctions, making its helicopters increasingly precarious. FT

- Fed officials acknowledged the progress in Apr’s CPI but warned against reading too much into a single number and said the battle against elevated inflation still has a ways to go. RTRS

- The Trump campaign and RNC reported that they jointly raised $76 million in April, about $25 million more than the Biden campaign said it raised across all its committees over the same period. Trump’s reported fundraising haul came as the former president was personally contacting high-dollar donors and encouraging them to give the maximum amount of more than $800,000 to the Trump 47 Committee, which he formed in March to merge fundraising forces with the RNC. WaPo

- Tencent suspended its hotly anticipated Dungeon & Fighter Mobile game within an hour of its China debut due to server glitches. Nintendo bought Shiver studio to help add games for its next Switch console. BBG

- MSFT may be closely aligned with ChatGPT, but the software giant is working on myriad AI initiatives both internally and with a slew of non-OpenAI external partners because at the end of the day it doesn’t necessarily care which model customers select, so long as they’re being run on Azure. Fortune

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were subdued following the somewhat indecisive performance on Wall St where price action was choppy amid a lack of catalysts and as participants await this week's key risk events. ASX 200 was lower as losses in materials and mining stocks offset the tech outperformance. Nikkei 225 was lifted at the open owing to recent currency weakness but then steadily gave back all of its initial gains alongside the downbeat risk appetite across most of its regional peers. Hang Seng and Shanghai Comp declined with underperformance in Hong Kong amid tech losses and with Li Auto shares down nearly 20% on weak earnings, while the mainland also conformed to the risk-averse mood albeit with downside limited by quiet newsflow.

Top Asian News

- Japanese Finance Minister Suzuki said a weak yen has positive and negative aspects, while he noted that at this point, they are concerned about the negative aspects of a weak yen and closely watching FX moves. Furthermore, Suzuki said they will deal appropriately as needed on forex and that it is desirable for forex to move in a stable manner, according to Reuters.

- RBA Minutes from the May 6th-7th meeting stated they considered whether to raise rates but judged the case for steady policy was the stronger one and the Board agreed it was difficult to either rule in or rule out future changes in the Cash Rate. RBA stated the flow of data had increased risks of inflation staying above target for longer and the Board expressed limited tolerance for inflation returning to target later than 2026, while a rate rise could be appropriate if forecasts proved overly optimistic and risks around forecasts were judged to be balanced.

- Carlyle has launched a new Japanese fund worth JPY 430bln (it's largest ever), according to the Nikkei

European bourses, Stoxx600 (-0.4%) opened on a softer footing and continued to trundle lower throughout the European morning. European sectors are mostly lower; Healthcare takes the top spot, led higher by gains in AstraZeneca (+1.5%) after outlining its 2030 plan, while giants Novo Nordisk, Roche, and Novartis resume trade after the Whit Monday holiday. US Equity Futures (ES U/C, NQ -0.1%, RTY -0.2%) are flat/modestly lower amid a lack of catalysts and after yesterday's indecisive Wall Street session.

Top European News

- EU's von der Leyen suggested making access to EU subsidies conditional on economic reforms as a potential method to improve the bloc's competitiveness, according to FT.

- Kantar UK Grocery Market Share: Grocery price inflation has also fallen for the fifteenth month in a row to 2.4%, the lowest level since October 2021.

- ASML (ASML NA) and TSMC (2330 TT) can disable chip machines if China invades Taiwan, according to Bloomberg

FX

- USD is incrementally softer vs. peers with DXY respecting yesterday's 104.39-79 range. A slew of Fed speakers may help to guide further price action.

- EUR is slightly firmer vs the Dollar, due to broader Dollar weakness rather than fresh EZ catalysts. After failing to recently launch a test of 1.09, the pair has since drifted lower with today's 1.0852 trough.

- GBP gains modestly vs. the USD. Focus for the GBP remains on Wednesday's inflation metrics, which could sway pricing for the June meeting. For now, Cable remains contained within yesterday's 1.2690-1.2726 range.

- USD/JPY near the unchanged mark after a bout of selling pressure in early European trade (not driven by any obvious catalyst) dragged the pair back from its overnight peak at 156.54. The pair is currently consolidating on a 156 handle awaiting fresh impetus.

- Antipodeans are both flat vs. the USD in quiet newsflow. AUD/USD unfazed by RBA minutes overnight but has made a fresh low at 0.6647 following yesterday's session of losses.

- CAD steady vs. the USD ahead of upcoming inflation data. ING posits that if the BoC's preferred core gauge (“median”) came in below 3.0%, that would "place all key inflation measures, core and headline, within the 1-3% inflation target band.

- PBoC set USD/CNY mid-point at 7.1069 vs exp. 7.2366 (prev. 7.1042).

Fixed Income

- USTs are flat trade with the recent slew of Fed speakers unable to have any meaningful sway on price action in what has been a quiet start to the week. For now, the Jun'24 contract is holding above the 109 mark and within yesterday's 108.30+-109.09 range.

- Bunds are leading peers in the wake of slightly softer-than-expected German PPI metrics. Price action could also be seen as an inevitable bounce following losses endured since last Thursday. Jun'24 Bund has recovered to circa 130.86 after basing out yesterday at 130.47. Modest downticks were seen on the Q1 EZ labour cost increase, with no reaction seen to the Bund auction.

- Gilts are firmer on the session but to a lesser extent than its German peer, and overall unreactive to a well-received Gilt auction. For now, Gilts are tucked within yesterday's 97.50-98.01 range.

- UK sells GBP 2.25bln 4.75% 2043 Gilt: b/c 3.67x (prev. 3.67x), average yield 4.580% (prev. 4.495%) & 0.4bps (prev. 0.1bps tail).

- Germany sells EUR 3.33 vs exp. EUR 4bln 2.10% 2029 Bobl: b/c 2.8x (prev. 2.6x), average yield 2.56% (prev. 2.41%) & retention 16.75% (prev. 18.25%)

Commodities

- Another downbeat session for the crude complex after July futures settled lower by around USD 0.30/bbl apiece in choppy trade; Brent July resides towards to bottom end of a current USD 82.81-83.76/bbl intraday range.

- Downbeat trade across precious metals as prices continue to pull back despite quiet newsflow but amid a lack of major geopolitical updates/escalations. XAU trades in the middle of a USD 2,406.16-2,433.14/oz intraday band.

- Base metals are mixed after the complex extended its rally yesterday, with copper prices breaking above USD 11,000/t and hitting record highs.

- Chinese April crude iron output +11.5% Y/Y at 87.90mln metric tons, according to the stats bureau; refined copper output +9.2%, lead +1.1% Y/Y, zinc -0.8% Y/Y

Geopolitics

- Israeli media on a source said National Security Advisor "Sullivan after meeting Netanyahu felt there was no strategy to end the war", via Al Arabiya

- "Israel has decided to shelve plans for a major offensive in the Gaza Strip’s southern city of Rafah, and will act in a more limited manner in the city, after discussions with the US on the matter", via Times of Israel citing WaPo analyst's sources.

- Yemen's Houthis said they have downed a US drone over the Baydaa Province, according to a statement

- US President Biden said what's happening in Gaza is not genocide and the US wants Hamas beaten, according to Reuters and Times of Israel.

- Deputy US Representative said the US proposed alternatives to a major ground offensive in Rafah and believes it will better advance Israel's goal, according to Al Jazeera.

- US top general said they are confident Ukraine has not used long-range US weaponry inside of Russia.

Econ Data

- 08:30: May Philadelphia Fed Non-Manufactu, prior -12.4

Central Bank speakers

- 04:00: Yellen, ECB’s Lagarde, Germany’s Lindner Speak

- 09:00: Fed’s Barkin Gives Welcome Remarks

- 09:00: Fed’s Waller Discusses US Economy

- 09:05: Fed’s Williams Gives Opening Remarks

- 09:10: Fed’s Bostic Offers Brief Welcome Remarks

- 11:45: Fed’s Barr Speaks in Fireside Chat

- 19:00: Fed’s Bostic Moderates Panel with Collins and Mester

DB's Jim Reid concludes the overnight wrap

In 16 plus years of writing the EMR it's usually finished off in the dark and with a very strong coffee. Today is one of those rare occasions where I hand over the reins whilst looking out over the ocean and with a cold refreshing drink.

Markets have started the week as becalmed as the Pacific Ocean looks as I type this, with the S&P 500 (+0.09%) consolidating less than a thousandth of a percent below last week’s all-time high ahead of Nvidia’s results tomorrow. Investors have grown more positive about a soft landing in the last couple of weeks, after having some doubts in April when the S&P 500 fell -4.16%. So far in May the index is up +5.41% (+11.29% YTD), with Nvidia’s +91.4% gain accounting for a quarter of its YTD rise. So as it stands, the S&P is on track for its strongest monthly gain since November. Markets are seemingly satisfied that inflation isn’t continuing to accelerate even if it’s notably higher than expected at the start of 2024. For example, back at the start of January the Bloomberg consensus for Q2 2024 headline US CPI inflation was at 2.7%. That forecast is now 3.4%. Q4 forecasts have gone up half a percentage point to 2.9%.

The market has instead focused on accommodative financial conditions, broadly resilient growth, a decent earnings season, inflation trending lower (even if not nearly as much as thought at the start of the year), and Fed cuts just being delayed rather than not happening. It would have been interesting to poll investors at the start of the year as to where they would have thought markets would be today had they known where inflation would have printed so far in 2024. So that combination probably would have been predicted by very few.

The rouge inflation prints haven't dented the soft landing optimism and this got some support from Fed speakers yesterday. In particular, Vice Chair Jefferson described the April inflation data as “encouraging”, and Vice Chair for Supervision Barr said that “I think we are in a good position to hold steady and closely watch how conditions evolve.” Such patience was also visible from San Francisco Fed President Daly who noted there was no “urgency” to adjust rates, while Cleveland Fed President Mester stated that “It’s too soon to tell what path inflation is on”. So similar to Powell’s recent comments, senior Fed officials are in no rush to think about rate cuts but are certainly not reacting that hawkishly to the latest inflation data either. Pricing of Fed rate cuts by year end fell by -3.1bps to 41bps yesterday, back to levels seen early last week before the April CPI print (having peaked at 52bps after the release). The next important date in the diary is on May 31, when we’ll get the full PCE inflation numbers for April, which is what they officially target.

There is another big round of central bank speakers today including the ECB's President Lagarde, the Fed’s Barkin, Waller, Williams, Bostic, Barr, Collins and Mester, along with BoE Governor Bailey.

With Fed officials sounding patient yesterday, it was a slower but generally positive day for equities. The S&P 500 (+0.09%) finished the day a hair's breadth below last week’s record high, having traded above it for much of the session. Tech outperformance did see the NASDAQ (+0.65%) and the Magnificent 7 (+0.43%) close at record highs, with Nvidia (+2.49%) leading the way ahead of its announcement tomorrow. Banks (-2.53%) underperformed within the S&P 500, led by JPMorgan (-4.50%) following comments by CEO Jamie Dimon that “We’re not going to buy back a lot of stock at these prices” and that a succession plan is “well on the way”.

Over in Europe it was a similar story, with the STOXX 600 (+0.18%) closing just shy of its record high from last week. Italy’s FTSE MIB index underperformed (-1.62%) but much of its decline came due to ex dividend date effects. The story was one of moderate gains elsewhere on the continent, including from the DAX (+0.35%), the CAC 40 (+0.35%) and the IBEX 35 (+0.10%).

Although most equities generally just missed out on new highs, gold prices (+0.47%) closed at a record high of $2,427/oz as investors continued to anticipate rate cuts this year. Separately, the iTraxx Crossover in Europe (-3.0bps) closed at its tightest level in over two years.

That sense that rate cuts were coming closer into view was evident from central bank speakers in Europe. For instance, BoE Deputy Governor Broadbent said in a speech that “ it’s possible Bank Rate could be cut some time over the summer.” And at the ECB, Latvia’s Kazaks said that “it’s quite likely June is going to be the time when we start the rate cuts”, although he did warn that the “process needs to be cautious, gradual and we should not rush.” Collectively, this supported the idea that the global monetary policy cycle was shifting towards an easing mode, although it had limited impact on market pricing. By the close overnight index swaps were pricing in a 96% chance of an ECB cut in June, and a 55% chance of a BoE cut in June (slightly down from 58% on Friday).

With this backdrop, sovereign bonds saw a modest sell off on both sides of the Atlantic. For example, yields on 10yr Treasuries were up +2.3bps to 4.445%, and those on 2yr Treasuries were up +2.4bps to 4.85%. High corporate issuance levels may have played a part. Meanwhile in Europe, yields on 10yr bunds (+1.3bps), OATs (+0.4bps) and BTPs (+0.3bps) all moved a little higher, whilst gilts saw the biggest underperformance despite Broadbent’s comments, with the 10yr yield up +4.1bps on the day.

Overnight in Asia, equity markets have lost ground across the region, with the Hang Seng (-2.05%) as the biggest underperformer amidst a decline in EV and tech stocks. Indeed, the Hang Seng TECH Index is down -3.18% this morning, putting it on track to end a run of 7 consecutive gains. Otherwise, the KOSPI (-0.58%), the Shanghai Comp (-0.41%) and the CSI 300 (-0.39%) are all negative, whilst the Nikkei (-0.04%) has also given up its earlier gains to move slightly lower. Sovereign bonds have also lost ground overnight, with the 2yr Japanese government bond yield (+0.6bps) at a post-2009 high of 0.34%. Australian government bonds lost ground as well after the minutes of the latest RBA meeting showed they had considered a rate hike. Looking forward, US equity futures are fairly stable though, with those on the S&P 500 up +0.02%.

To the day ahead now, and central bank speakers include ECB President Lagarde, the Fed’s Barkin, Waller, Williams, Bostic, Barr, Collins and Mester, along with BoE Governor Bailey. Otherwise, data releases include Canadian CPI and German PPI for April.