Authored by Mike Shedlock via MishTalk.com,

For many reasons, the Fed will struggle to contain inflation. This is part one on the Fed’s struggle. It covers deficit spending and interest on the debt.

Key Points

-

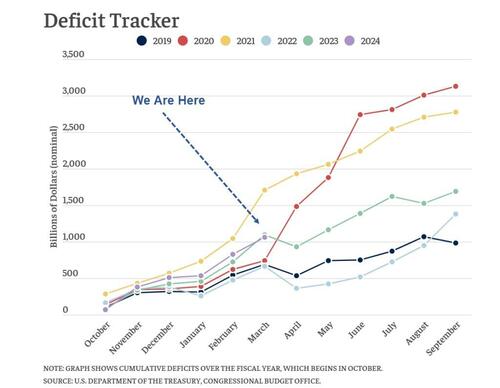

The government is running a cumulative deficit of $1.1 trillion so far in FY2024 ($46 billion more than the same period in the prior fiscal year when adjusted for timing shifts)

-

Revenues were $2.2 trillion through February

-

Outlays were $3.3 trillion through March

The above is according to the Bipartisan Policy Organization.

Those numbers do not include a $95 billion aid bill for Ukraine and Israel that recently passed Congress.

The projections look worse.

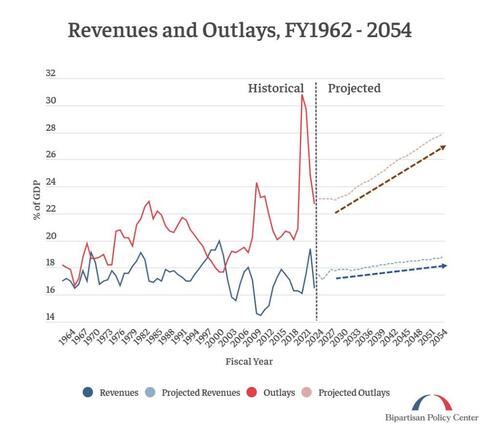

Revenue and Outlays Projections

“As spending continues to outpace revenues, deficits will exceed $1.5 trillion (an average of 5.6% of GDP) in each of the next ten years. In comparison to May 2023’s budget outlook, deficits are projected to be a cumulative $1.4 trillion less over FY2024-2033.”

This report as well as White House economic projections, and Congressional Budget Office projections are all too optimistic.

Q: Why?

A: None of them factor in a recession all the way through 2054.

The Fed makes the same optimistic assumptions in its projections.

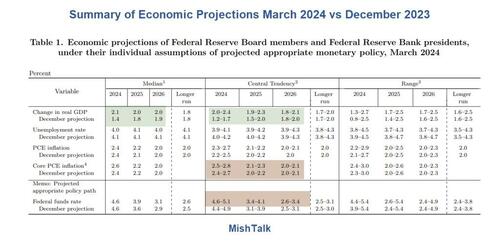

Fed Summary of Economic Projections March 2024 vs December 2023

Compared to December of 2023 the Fed upped its central tendency of GDP expectations, core inflation, and the expected Fed Funds Rate as noted in my March 20, assessment Fed’s Dot Plot is More Hawkish Towards Cuts in March vs. December

The key points are the Fed assumes no recessions and the Fed assumes no matter what Congress does that it will hold inflation to two percent over the long term.

In other words, the Fed assumes that it is in control when history suggests that it isn’t.

The Fed has never forecast a recession, nor has the Fed spotted one in real time.

The deficit is now over $34 trillion with debt held by the public at $27 trillion. Interest on the national debt is over $1 trillion.

Money that would go for investment instead goes to bondholders.

Neither party will fix deficit spending. Nor will the Fed.

And it will get worse in the next recession. Unrestrained fiscal stimulus contributed to the mess we are in, and nothing suggests a policy change no matter who wins the election.

In the past two decades, the Fed did have some favorable global factors that held down inflation. Those factors are gone. I will discuss the differences in my next segment.

Meanwhile, please consider my question Dear Jerome Powell, Is Everything Under Control?

Authored by Mike Shedlock via MishTalk.com,

For many reasons, the Fed will struggle to contain inflation. This is part one on the Fed’s struggle. It covers deficit spending and interest on the debt.

Key Points

-

The government is running a cumulative deficit of $1.1 trillion so far in FY2024 ($46 billion more than the same period in the prior fiscal year when adjusted for timing shifts)

-

Revenues were $2.2 trillion through February

-

Outlays were $3.3 trillion through March

The above is according to the Bipartisan Policy Organization.

Those numbers do not include a $95 billion aid bill for Ukraine and Israel that recently passed Congress.

The projections look worse.

Revenue and Outlays Projections

“As spending continues to outpace revenues, deficits will exceed $1.5 trillion (an average of 5.6% of GDP) in each of the next ten years. In comparison to May 2023’s budget outlook, deficits are projected to be a cumulative $1.4 trillion less over FY2024-2033.”

This report as well as White House economic projections, and Congressional Budget Office projections are all too optimistic.

Q: Why?

A: None of them factor in a recession all the way through 2054.

The Fed makes the same optimistic assumptions in its projections.

Fed Summary of Economic Projections March 2024 vs December 2023

Compared to December of 2023 the Fed upped its central tendency of GDP expectations, core inflation, and the expected Fed Funds Rate as noted in my March 20, assessment Fed’s Dot Plot is More Hawkish Towards Cuts in March vs. December

The key points are the Fed assumes no recessions and the Fed assumes no matter what Congress does that it will hold inflation to two percent over the long term.

In other words, the Fed assumes that it is in control when history suggests that it isn’t.

The Fed has never forecast a recession, nor has the Fed spotted one in real time.

The deficit is now over $34 trillion with debt held by the public at $27 trillion. Interest on the national debt is over $1 trillion.

Money that would go for investment instead goes to bondholders.

Neither party will fix deficit spending. Nor will the Fed.

And it will get worse in the next recession. Unrestrained fiscal stimulus contributed to the mess we are in, and nothing suggests a policy change no matter who wins the election.

In the past two decades, the Fed did have some favorable global factors that held down inflation. Those factors are gone. I will discuss the differences in my next segment.

Meanwhile, please consider my question Dear Jerome Powell, Is Everything Under Control?