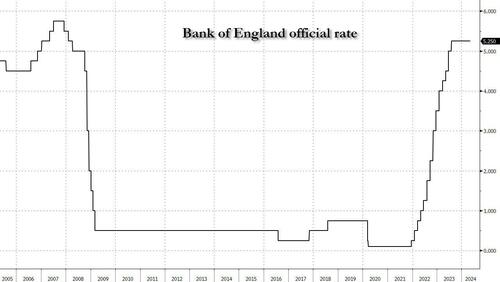

With both the Swiss SNB and Swedish Riksbank recently starting rate cuts, many were wondering if the BOE would be next to join the easing cycle. And while it did not, instead keeping rates unchanged at 5.25% for the sixth straight meeting, in line with what investors and economists had been expecting, the central bank did indicate it is on course to cut rates from a 16 year high over the coming months alongside its European peers as two of the nine members of its Monetary Policy Committee, including the deputy governor, voted to lower the key rate to 5%.

The Monetary Policy Committee voted by a majority of 7-2 to maintain #BankRate at 5.25%. Find out more in our #MonetaryPolicyReport: https://t.co/2lnXthHbMt pic.twitter.com/HXZdRjxPnl

— Bank of England (@bankofengland) May 9, 2024

Deputy Governor Dave Ramsden joined external member Swati Dhingra in calling for an immediate cut in the base rate from its current level of 5.25%. The other seven members of the Monetary Policy Committee preferred no change, saying they needed more evidence that inflation will be subdued.

It was the sixth meeting running that the UK central bank left its benchmark lending rate firmly in territory it describes as restrictive, aiming to bear down on wage and price pressures that reached a four-decade high in late 2022. Forecasts released with the decision suggested the BOE will have to reduce rates in the coming months, probably before a general election widely expected in the autumn.

The BOE will next meet in June, and then again in August. A cut at either meeting would likely see the BOE move before the Federal Reserve, which is now facing the prospect of keeping rates higher for longer. Cutting before the Fed would risk weakening the pound sterling against the U.S. dollar and pushing prices of imported goods and services higher. But waiting too long could delay an economic recovery and lead to job losses.

“We’ve had encouraging news on inflation, and we think it will fall close to our 2% target in the next couple of months,” Bailey said in a statement Thursday. “We need to see more evidence that inflation will stay low before we can cut interest rates. I’m optimistic that thing are moving in the right direction.”

Inflation in the U.K. has fallen steadily over recent months, and the BOE said it likely hit its 2% target in April, though official figures won’t be released until May 22. By contrast, inflation readings from the U.S. have been hotter than expected for a number of months, prompting the Fed to adopt a wait-and-see approach to future policy decisions.

The BOE expects inflation to pick up again toward the end of this year, and fall again in the second half of 2025. The bank''s policymakers forecast that inflation will be just below their 2% target in mid-2026 even if they cut interest rates at the pace expected by investors. That indicates that the central bank is comfortable with the trajectory for its key rate expected by investors, who see August as the most likely month for a first move, with two further cuts by mid-2025 and additional moves to 3.75% by the second quarter of 2027.

In the context of developed central banks, both Switzerland and Sweden have already lowered their key interest rates for the first time since the inflation surge began in 2021, while the European Central Bank has strongly indicated that it will cut in early June.

The likely divergence in policy settings reflects differing economic fortunes. While the U.S. economy has grown rapidly over the last 18 months, the U.K. and much of the rest of Europe stalled following the surge in energy and food prices triggered by Russia’s invasion of Ukraine.

Still, there are signs that the U.K. is starting to recover from that shock. Economic output fell in the final six months of last year, but the BOE estimates it rose again in the first three months of 2024 and will do so again in the current quarter. The central bank raised its forecast for growth this year to 0.5% from 0.25%, and its forecast for next year to 1% from 0.75%. It attributed the stronger outlook to higher-than-expected population growth.

Policymakers are increasingly confident that growth can pick up without pushing inflation above their target. They have worried that wages would continue to rise rapidly in a tight jobs market, preventing a cooling in the pace of price rises for labor-intensive services.

Gilts rose and the pound fell after the decision. Traders briefly priced a 50% possibility for the first 25 basis-point cut to come next month, and continued to fully priced in a cut by August. Markets now imply a total of 57 basis points of cuts through 2024, compared to 54 basis points before. Still, considering the thrust of the BoE's communication, UBS writes that it is "surprising" market pricing hasn't shifted further towards a June cut – especially since Governor Bailey has indicated it's up for consideration, commenting that the BoE is likely to cut rates in the quarters ahead, possibly by more than the markets are currently expecting. June prices around 14bp against 13bp heading into the MPC.

With both the Swiss SNB and Swedish Riksbank recently starting rate cuts, many were wondering if the BOE would be next to join the easing cycle. And while it did not, instead keeping rates unchanged at 5.25% for the sixth straight meeting, in line with what investors and economists had been expecting, the central bank did indicate it is on course to cut rates from a 16 year high over the coming months alongside its European peers as two of the nine members of its Monetary Policy Committee, including the deputy governor, voted to lower the key rate to 5%.

The Monetary Policy Committee voted by a majority of 7-2 to maintain #BankRate at 5.25%. Find out more in our #MonetaryPolicyReport: https://t.co/2lnXthHbMt pic.twitter.com/HXZdRjxPnl

— Bank of England (@bankofengland) May 9, 2024

Deputy Governor Dave Ramsden joined external member Swati Dhingra in calling for an immediate cut in the base rate from its current level of 5.25%. The other seven members of the Monetary Policy Committee preferred no change, saying they needed more evidence that inflation will be subdued.

It was the sixth meeting running that the UK central bank left its benchmark lending rate firmly in territory it describes as restrictive, aiming to bear down on wage and price pressures that reached a four-decade high in late 2022. Forecasts released with the decision suggested the BOE will have to reduce rates in the coming months, probably before a general election widely expected in the autumn.

The BOE will next meet in June, and then again in August. A cut at either meeting would likely see the BOE move before the Federal Reserve, which is now facing the prospect of keeping rates higher for longer. Cutting before the Fed would risk weakening the pound sterling against the U.S. dollar and pushing prices of imported goods and services higher. But waiting too long could delay an economic recovery and lead to job losses.

“We’ve had encouraging news on inflation, and we think it will fall close to our 2% target in the next couple of months,” Bailey said in a statement Thursday. “We need to see more evidence that inflation will stay low before we can cut interest rates. I’m optimistic that thing are moving in the right direction.”

Inflation in the U.K. has fallen steadily over recent months, and the BOE said it likely hit its 2% target in April, though official figures won’t be released until May 22. By contrast, inflation readings from the U.S. have been hotter than expected for a number of months, prompting the Fed to adopt a wait-and-see approach to future policy decisions.

The BOE expects inflation to pick up again toward the end of this year, and fall again in the second half of 2025. The bank''s policymakers forecast that inflation will be just below their 2% target in mid-2026 even if they cut interest rates at the pace expected by investors. That indicates that the central bank is comfortable with the trajectory for its key rate expected by investors, who see August as the most likely month for a first move, with two further cuts by mid-2025 and additional moves to 3.75% by the second quarter of 2027.

In the context of developed central banks, both Switzerland and Sweden have already lowered their key interest rates for the first time since the inflation surge began in 2021, while the European Central Bank has strongly indicated that it will cut in early June.

The likely divergence in policy settings reflects differing economic fortunes. While the U.S. economy has grown rapidly over the last 18 months, the U.K. and much of the rest of Europe stalled following the surge in energy and food prices triggered by Russia’s invasion of Ukraine.

Still, there are signs that the U.K. is starting to recover from that shock. Economic output fell in the final six months of last year, but the BOE estimates it rose again in the first three months of 2024 and will do so again in the current quarter. The central bank raised its forecast for growth this year to 0.5% from 0.25%, and its forecast for next year to 1% from 0.75%. It attributed the stronger outlook to higher-than-expected population growth.

Policymakers are increasingly confident that growth can pick up without pushing inflation above their target. They have worried that wages would continue to rise rapidly in a tight jobs market, preventing a cooling in the pace of price rises for labor-intensive services.

Gilts rose and the pound fell after the decision. Traders briefly priced a 50% possibility for the first 25 basis-point cut to come next month, and continued to fully priced in a cut by August. Markets now imply a total of 57 basis points of cuts through 2024, compared to 54 basis points before. Still, considering the thrust of the BoE's communication, UBS writes that it is "surprising" market pricing hasn't shifted further towards a June cut – especially since Governor Bailey has indicated it's up for consideration, commenting that the BoE is likely to cut rates in the quarters ahead, possibly by more than the markets are currently expecting. June prices around 14bp against 13bp heading into the MPC.