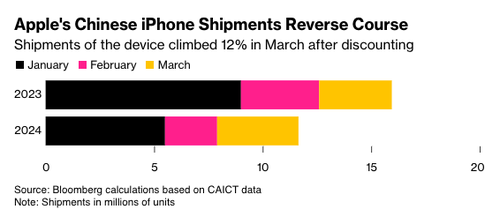

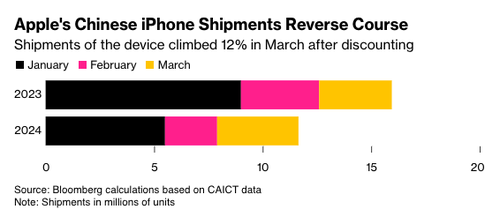

New data shows iPhone shipments in China surged in March, reversing a previous multi-month decline. This increase comes after Apple discounted handset prices throughout the first quarter, mostly in response to waning demand due to unofficial bans on the device by government agencies and competition from local brands.

Bloomberg cites official data from a new monthly report by the China Academy of Information and Communications Technology showing iPhone shipments in China bounced 12% in March.

Shipments of foreign-branded smartphones—most of which are Apple iPhones—increased to 3.75 million units in March from a year earlier. This follows a 37% decline in the first two months of the year.

A report from the beginning of the year showed Apple offered an 'ultra-rare' iPhone discount of up to 500 yuan ($70)

At the time, Apple's website stated, "Discounts this year encompass everything from the iPhone 13 to the iPhone 15 Pro Max."

The rare discount was made shortly after analysts from Piper Sandler and Barclays downgraded Apple due to slumping iPhone demand.

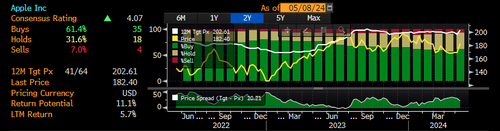

Currently, analysts tracked by Bloomberg show Apple has 35 "buys," 18 "holds," and 4 "sells."

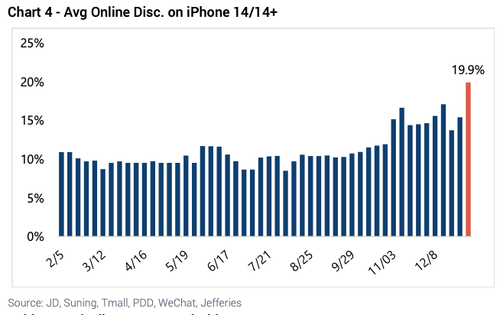

The discounts early this year were the highest on record, according to analysts from Jefferies.

At the time, we noted the two main drivers driving iPhone sales lower in the world's largest handset market:

- We suspect the made-in-China Mate 60 Pro, which defied Western tech sanctions and has a top-of-the-line processor, has spurred patriotic fervor among Mainland consumers for domestic handsets.

- Also, companies and government agencies have told staffers to abandon Apple devices.

Last week, Apple CEO Tim Cook addressed an analyst's question about the March quarter. He said iPhone revenue in mainland China increased "on a reported basis" before adjustments for Covid-related supply chain disruptions in 2022.

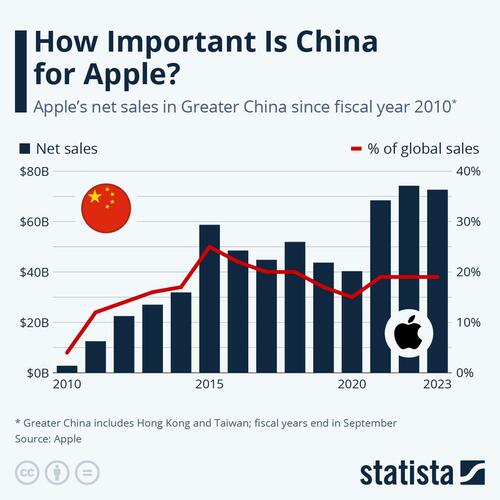

Cook did not provide further details on this metric but reiterated Apple's commitment to the Chinese market, which, despite its contraction, still represents 18% of the company's net sales.

According to Statista data, China is very important to Apple, accounting for nearly 20% of the company's total sales.

This is why analysts and investors closely watch iPhone demand trends in the world's second-largest economy.

New data shows iPhone shipments in China surged in March, reversing a previous multi-month decline. This increase comes after Apple discounted handset prices throughout the first quarter, mostly in response to waning demand due to unofficial bans on the device by government agencies and competition from local brands.

Bloomberg cites official data from a new monthly report by the China Academy of Information and Communications Technology showing iPhone shipments in China bounced 12% in March.

Shipments of foreign-branded smartphones—most of which are Apple iPhones—increased to 3.75 million units in March from a year earlier. This follows a 37% decline in the first two months of the year.

A report from the beginning of the year showed Apple offered an 'ultra-rare' iPhone discount of up to 500 yuan ($70)

At the time, Apple's website stated, "Discounts this year encompass everything from the iPhone 13 to the iPhone 15 Pro Max."

The rare discount was made shortly after analysts from Piper Sandler and Barclays downgraded Apple due to slumping iPhone demand.

Currently, analysts tracked by Bloomberg show Apple has 35 "buys," 18 "holds," and 4 "sells."

The discounts early this year were the highest on record, according to analysts from Jefferies.

At the time, we noted the two main drivers driving iPhone sales lower in the world's largest handset market:

- We suspect the made-in-China Mate 60 Pro, which defied Western tech sanctions and has a top-of-the-line processor, has spurred patriotic fervor among Mainland consumers for domestic handsets.

- Also, companies and government agencies have told staffers to abandon Apple devices.

Last week, Apple CEO Tim Cook addressed an analyst's question about the March quarter. He said iPhone revenue in mainland China increased "on a reported basis" before adjustments for Covid-related supply chain disruptions in 2022.

Cook did not provide further details on this metric but reiterated Apple's commitment to the Chinese market, which, despite its contraction, still represents 18% of the company's net sales.

According to Statista data, China is very important to Apple, accounting for nearly 20% of the company's total sales.

This is why analysts and investors closely watch iPhone demand trends in the world's second-largest economy.