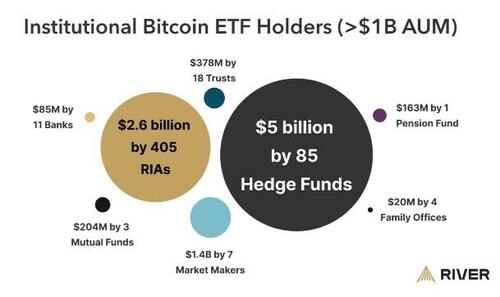

534 institutions with over $1 billion in assets now hold Bitcoin ETFs, according to bitcoin app River.

In a blog post published this week, River noted that over 534 entities, each managing assets exceeding $1 billion, have now incorporated Bitcoin ETFs into their portfolios.

The diverse group of owners includes hedge funds, pension funds, and insurance companies, underscoring the wide-ranging acceptance of Bitcoin, the blog wrote, adding that notably, more than half of the top 25 hedge funds in the United States are now exposed to Bitcoin.

Among these are Millennium Management, which now holds an impressive $2 billion in Bitcoin assets. Furthermore, 11 of the top 25 Registered Investment Advisors (RIAs), alongside numerous smaller advisors, have also allocated investments in Bitcoin.

“If you sell your bitcoin to Blackrock, you probably won’t be getting it back," River's CEO Alex Leishman said.

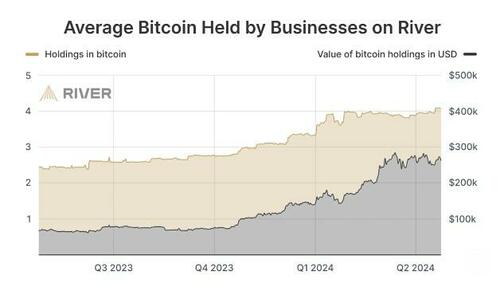

Specific to their company, they wrote that they are witnessing a trend of bitcoin becoming a staple on every company's balance sheet live.

Currently, over a thousand companies using River's platform maintain bitcoin in their financial reserves, the company wrote. Just a year ago, the typical business held 2.5 BTC, valued at approximately $70,000. Since then, these holdings have grown to more than 4 BTC, with their value surging to beyond $280,000.

They wrote: "It is no longer just the MicroStrategy’s of the world accumulating Bitcoin, but businesses of all sizes."

Recall days ago, Michael Saylor commented in wide-ranging interview that bitcoin had now officially pierced the veil into the KYC and AML regulated banking world.

When asked about how bitcoin is homogenizing itself in a world of increasing regulations, he said: “I think it's doing it now. I mean, you're watching it, right? For example, Block sells $10 billion worth of Bitcoin every year via Cash App. They're a publicly traded company. They abide by AML and KYC regulations. They have compliance. They have responsibilities."

“Fidelity, you know, Fidelity Digital Assets is custodying billions and billions of dollars of Bitcoin. I'm sure they've got an army of lawyers and finance people thinking about it.”

534 institutions with over $1 billion in assets now hold Bitcoin ETFs, according to bitcoin app River.

In a blog post published this week, River noted that over 534 entities, each managing assets exceeding $1 billion, have now incorporated Bitcoin ETFs into their portfolios.

The diverse group of owners includes hedge funds, pension funds, and insurance companies, underscoring the wide-ranging acceptance of Bitcoin, the blog wrote, adding that notably, more than half of the top 25 hedge funds in the United States are now exposed to Bitcoin.

Among these are Millennium Management, which now holds an impressive $2 billion in Bitcoin assets. Furthermore, 11 of the top 25 Registered Investment Advisors (RIAs), alongside numerous smaller advisors, have also allocated investments in Bitcoin.

“If you sell your bitcoin to Blackrock, you probably won’t be getting it back," River's CEO Alex Leishman said.

Specific to their company, they wrote that they are witnessing a trend of bitcoin becoming a staple on every company's balance sheet live.

Currently, over a thousand companies using River's platform maintain bitcoin in their financial reserves, the company wrote. Just a year ago, the typical business held 2.5 BTC, valued at approximately $70,000. Since then, these holdings have grown to more than 4 BTC, with their value surging to beyond $280,000.

They wrote: "It is no longer just the MicroStrategy’s of the world accumulating Bitcoin, but businesses of all sizes."

Recall days ago, Michael Saylor commented in wide-ranging interview that bitcoin had now officially pierced the veil into the KYC and AML regulated banking world.

When asked about how bitcoin is homogenizing itself in a world of increasing regulations, he said: “I think it's doing it now. I mean, you're watching it, right? For example, Block sells $10 billion worth of Bitcoin every year via Cash App. They're a publicly traded company. They abide by AML and KYC regulations. They have compliance. They have responsibilities."

“Fidelity, you know, Fidelity Digital Assets is custodying billions and billions of dollars of Bitcoin. I'm sure they've got an army of lawyers and finance people thinking about it.”