https://ift.tt/3ptvBe6

70.87 Billion Reasons Why The Retail Brokers Just Betrayed Their Customers

Yesterday, when TD Ameritrade became the first exchange to impose "unprecedented" restrictions on GME trading, we predicted what would happen next: "expect many more exchanges to follow suit, because hedge funds clearly need to be protected when faced with the retail daytrading mob."

24 hours later, we were proven correct when first Robinhood (an "orderflow" cash cow for Melvin Capital owner Citadel), then Interactive Brokers, then Schwab and countless other brokerages announced - as if on preagreed terms - to halt trading in GME, AMC, BB, BBY, EXPR, KOSS, NAKD, NOK, SNDL, ALL and various other names.

“We’re committed to helping our customers navigate this uncertainty,” Robinhood said in a blog post, but few saw it that way.

The irony of @RobinhoodApp being named Robinhood when very clearly their entire agenda is to steal from poor and give more to the rich is not lost on me.

— Dave Portnoy (@stoolpresidente) January 28, 2021

This crackdown on retail trading sparked a firestorm, with retail investors rightfully demanding to know why these stocks (and associated options) were put on some ad hoc restricted list with no warning and threatening to take their money and go to more hospitable brokers, politicians threatening that hearings are coming, regulators threatening that lawsuits are coming, and everyone generally shocked at just how openly broken the market is.

Following Robinhood’s move, the brokerage was hit by at least two customer lawsuits. Dave Portnoy, a recent participant in the Reddit-fueled rally, was among those who slammed Robinhood for its decision. “Robinhood is dead,” Portnoy screamed on Twitter. Ocasio-Cortez tweeted that she would welcome a hearing in the House Financial Services Committee, to discuss why hedge funds can freely trade the stocks and retail users are blocked. Even Elon Musk approved of the tweet.

Emergency Press Conference - Everybody On Wall Street Who Had A Hand In Today’s Crime Needs To Go To Prison pic.twitter.com/aKr8aPbB3Z

— Dave Portnoy (@stoolpresidente) January 28, 2021

But what was the reason for this unprecedented crackdown? After all, during countless episodes of market turmoil before, brokers had never taken it upon themselves to become the market's supervisor and suspend trading in one or more shares.

It appears that there are several reasons, the first of which may have to do with some backroom deals.

First, consider that Citadel, which as regular readers know is the biggest source of revenue for Robinhood...

... is also now a part-owner of the insolvent bearish hedge fund Melvin Capital (which as recently as last week had $12BN in AUM) which would have collapsed and been forced to liquidate its longs, had it not received $2 billion from Citadel and another $750MM from Steve Cohen. In other words, while nobody has called it that yet, we just lived through a mini LTCM.

Here's the problem: with the r/wasllstreetbets crowd continuing to press the shorts, we were about to have a second, not so mini LTCM, because as CNBC's David Faber earlier today noted, Melvin Capital "is in trouble" after suffering "massive losses" and the infusion from Citadel and Point72 "is probably gone."

Said otherwise, if the squeeze had continued Citadel and Point72 would have had to bail out Melvin Capital again (which is odd since it was CNBC that also reported yesterday that the hedge fund had closed its shorts... which apparently was not exactly true). And while $2.75 billion may be pocket change for Ken and Steve, $5 billion starts to look like real money. And what if it has to be followed by $10 billion, $20... and so on. On the other hand, if they did not throw more good money after bad, not only would their initial investment be wiped out, but once Mevlin was forced to start selling its longs to fund its margin calls - which also happen to be the names contained in the Goldman Sachs Hedge Fund VIP basket biggest longs for Citadel and Point72 - that's when the real carnage would take place as everyone would scramble to frontrun the upcoming liquidation. The result would have been billions in losses for Citadel and Point72.

Surely the best outcome - for Melvin's forced owners - would be to simply stop the firehose of liquidity whichever way possible, and after a few back door phone calls, which we hope to learn all about during the upcoming Congressional hearings, that's precisely what happened.

But Citadel and SAC Point72 were not the only ones on the firing line. As Faber also said earlier, "any number of large of large hedge funds have suffered significantly."

How much? According to financial data analytics firm Ortex, short-sellers - mostly hedge funds - are sitting on estimated losses of $70.87 billion from their short positions in U.S. companies just in 2021 alone! Add puts and other underwater derivatives, and the real loss will be even greater. And just as striking: Ortex data showed that as of Wednesday, there were loss-making short positions on more than 5,000 U.S. firms.

This means that virtually every hedge fund that had short positions on was getting hammered. So when dozens of these giant asset managers sat down and decided to polite call one broker after another what do you think happened.

That's right: Joe Sixpack was quickly sold down the river.

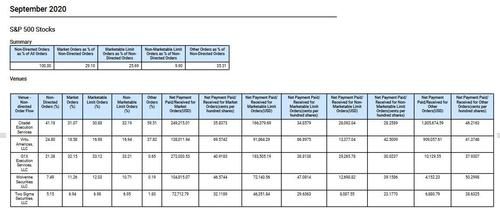

Why? Because the so-called "retail clients" are nothing but a cost center to the "retail brokers" thanks to the recently introduced $0 commission pay scheme. In fact, brokers would be delighted to dump all but their biggest whales clients. So who pays the fees? Well, just take a look at Robinhood's form 606: Citadel, Virtu, G1X, Wolverine, and countless hedge funds which, like Citadel, are tightly interwoven in the fabric of the market. It's they that made a few phone call and just put dozens of stocks on a market-wide restricted list.

There's more. While unconfirmed, there is speculation that that "Citadel reloaded their shorts before they told Robinhood to stop trading GME." As the source notes, if true the people behind this should be in jail.

Just got a tip that Citadel reloaded their shorts before they told Robinhood to stop trading $GME.

— Justin Kan (@justinkan) January 28, 2021

If this is true, Ken Griffin and the Robinhood founders should be in jail.

This is class warfare.

Perhaps this is true, perhaps not. We'll find out soon.

But what we really want to find out is when the brokers will again allow trading in GME, AMC, and so on. What will be the catalyst? Will it be when hedge funds have finally covered their shorts, at which point there will be no further need for a squeeze.

If that's indeed the case, it'll tell us all we need to know about who truly runs the erroneously called "free markets."

news

via ZeroHedge News https://ift.tt/3gAjc4o

January 28, 2021 at 02:21PM